Share this post

Rational exuberance?

November, 2017

Warren Buffett has become famous for his long term views on investment and focus on a few key investment principles. Some of his quotes are very pertinent in the current environment as investors are beginning to show signs of acting irrationally:

“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.”

“It’s only when the tide goes out that you discover who’s been swimming naked.”

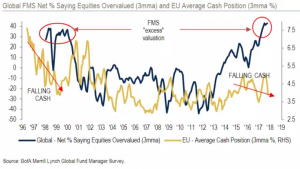

The chart below is taken from a recent industry study that compiles the views of global fund managers and aims to provide a gauge of optimism or pessimism in the industry.

The above chart shows that most investors are not behaving rationally. They believe equity markets are overvalued but hold less cash, implying investors are chasing returns and ignoring risks. This is one of the key factors that we have been watching for to gauge irrational behaviour in the equity markets as we continue to be told that investors are not bullish as they remain scarred by the 2008 financial crisis. This chart shows clearly that this is no longer the case, and in fact, the past two years have seen a significant rise in investor concern about equity market valuations.

The most interesting point is that cash balances in strategies have continued to fall even whilst investors are expressing concerns about valuations: this breakdown in relationship is unlikely to last in the medium term. Having said this, when this relationship recouples it is likely to be driven by other factors and not equity market valuations. The political and interest rate environment will likely lead to this relationship becoming relevant again.

At Tacit we believe that very few investors succeed with market chasing strategies. Today’s valuation of the investments you own has historically driven returns over the medium term and therefore we remain focused on the valuation of these assets in the context of our medium term objective. The above chart is a reminder, if one is needed, that we are investing in a period where historic relationships have broken down in the short term, however we believe firmly that longer term relationships do matter.

One final quote from the Sage of Omaha which is relevant today more than ever: “Price is what you pay. Value is what you get.”