Share this post

Why we shouldn’t cry for Argentina

September, 2018

We got all sentimental this week. We held our quarterly Investment Strategy Group meeting to discuss opportunities and risks in global markets. Someone brought up Argentina and the words of the hit song came flooding back. “And as for fortune and as for fame, I never invited them in.” And so on.

So why Argentina? The recent sell-off in emerging markets accompanied by declines in the local currencies has made some EM equities relatively cheap. But often this isn’t enough in these markets. Because of the larger political and economic risks involved, our attitude at Tacit Investment Management is to tread carefully when considering any investment in this area.

The economic health of emerging markets isn’t all bad though. Countries that aren’t highly indebted relative to GDP, with comparatively stable currencies and large foreign reserves are better positioned to weather the storm. Very few countries meet these three criteria but at current prices, Brazil and Mexico look attractive.

And this is where Argentina came up. It doesn’t look in great shape with double digit inflation and a steep devaluation of its currency. You know the old saying how getting drunk is like borrowing happiness from tomorrow? Well we agreed that taking on excessive debt isn’t that different from getting drunk. The harsh reality is that Argentina has defaulted on its international debt seven times since its independence in 1816. This is like getting drunk and not even bothering to pay for the drinks.

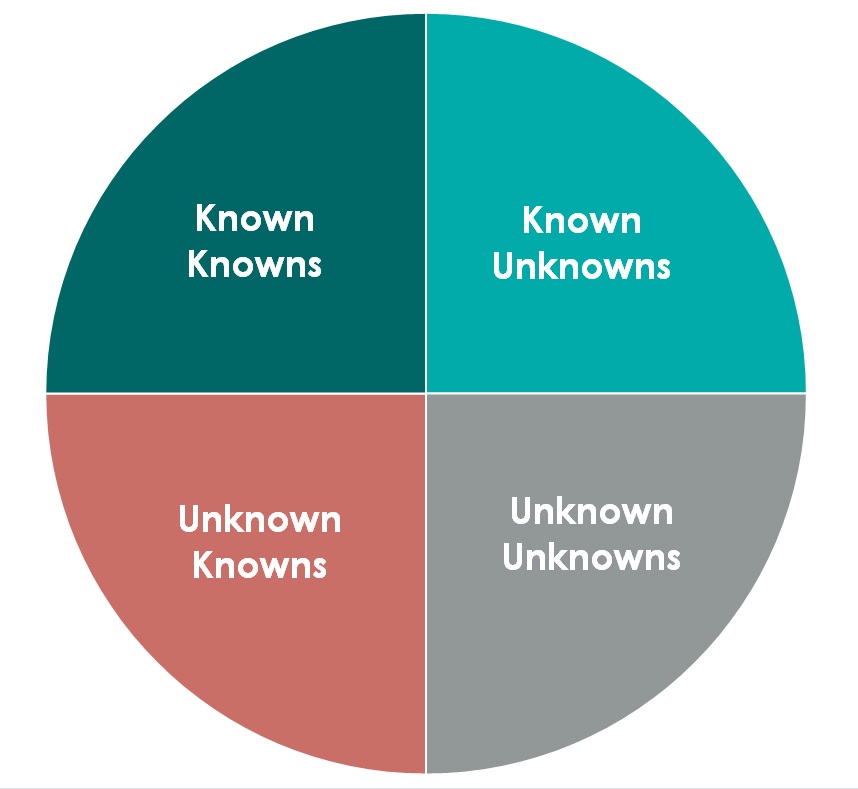

The risks we discussed at the ISG were mainly political. It helped to frame them all by grouping into four sections as shown.

Known knowns are things that most of us are aware of and know. In investing, this is generally unhelpful information because the market knows about them too. Unknown unknowns are also not particularly useful either because they too do what they say on the tin.

Unknown knowns are those things you’re not aware that you know. These are predictable, but you don’t have enough information to make good forecasts.

Known unknowns could happen but are difficult to predict in advance. A cancelled air flight for example. Most of the political risks surrounding the uncertainties of Brexit can be called known unknowns.

Investing as we see it is about opportunity costs. And our exposure to large UK companies which generate a sizeable share of their revenues from abroad is a good hedge against the uncertainties of Brexit.

Emerging markets stocks and UK stocks are equally cheap. But our belief is that UK stocks have twice the dividend yield and also, importantly, carry less risk.