Share this post

Why not the UK?

April, 2024

The UK stock market has been stuck at these levels for what feels like forever. The chart below shows how the UK stock market has broadly tracked sideways in price terms (excluding dividends) since the turn of the century. On all conventional and comparative historic measures it appears cheap: so why does it not go up by more?

For share prices to rise only one of the following factors is required:

- Earnings growth

- Increasing dividends

- Multiple expansion

- Demand for the share exceeds supply

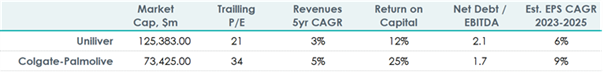

When you consider the companies listed on the UK stock market taking account of these factors, many do not compare favourably with alternatives available to investors around the world. As an example, the table below shows two comparable businesses, listed on different exchanges, and their current price, historic growth rates, return on equity and their levels of debt.

In short, the UK listed business, namely Unilever, has higher debt levels (therefore higher interest payments), lower historic and expected growth rates, and a lower return on equity than the US listed peer. This is a simplistic analysis, however, it applies broadly across these competing markets and highlights why UK equities have been squeezed out of global portfolios over time.

The UK does have examples of world leading businesses which grow at superior rates to their peers but there just are not enough of them to drive the broader index at this stage.

A combination of higher debt servicing costs, higher relative taxation levels, and higher dividend expectations from shareholders, alongside lower growth rates lead us to wonder why the UK stock market, even though it is cheap by conventional measures, would perform better than other markets with stronger company fundamentals. Ultimately, higher growth rates are needed, financed by much higher levels of investment of retained earnings, to increase the share prices of many UK listed companies.

Our analysis highlights that other regions provide a more compelling investment opportunity than the UK, even though it is cheap when considered in isolation.