Share this post

Why do all roads lead to the US?

May, 2022

Recency bias is a cognitive bias that tends to place greater emphasis on more recent experiences and memories, even if they are not the most relevant or reliable.

For investors this behavioural bias manifests itself all too often and can be challenging to avoid as more recent financial market events cloud judgement. It convinces us that a rising market or individual stock will continue to appreciate, or that a declining market or stock is likely to keep falling.

Fresh in the minds of growth investors are the losses they have experienced in US equities since the turn of year. At the time of writing, the NASDAQ Composite Index had lost -27% in US$ terms (technically a bear market). If recency bias takes hold, investors do not objectively evaluate the long-term investment opportunities that are presented and refrain from buying assets in a bear market because they remain pessimistic about its prospects of recovery.

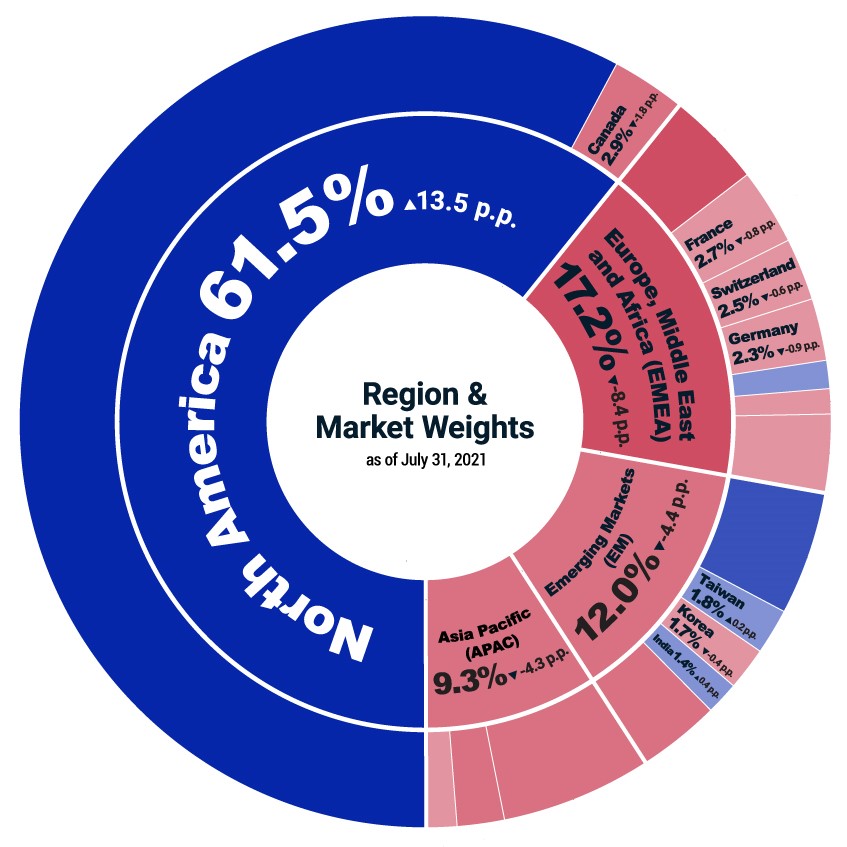

We have spent many years considering the imbalances caused by the USA and its dominance in the global economy. Can it be right that the country that holds only 5% of world’s population generates over half of the world’s economic activity? From an investment perspective the numbers are even more stark. The chart below shows that the US stock market has actually risen from nearly 50% to over 61% of the global market over the past decade.

Source: Visualcapitalist.com, MSCI (July 2021).

Why is this the case? Why do other countries stock markets continue to be squeezed by the US?

The answer to this question we believe lies in the US dollar. As the reserve currency of the world, the US dollar attracts investment like no other. In the past it used to benefit currencies like the UK Pound and Japanese Yen, but it is the US dollar that has taken on the role of reserve currency of the world since the mid-1970s. Nearly half of all trade globally is settled in U.S. dollars and therefore it is easier for companies to have a US dollar base (listing) in the modern world.

UK investors have historically had an aversion to US equities as the stock market has traded on a valuation premium to other markets. It is at this point that we firmly believe investors must not let the recent technology stock rout cloud the longer-term merits of US equities. Not only have they provided higher cash flows and growth rates for over 30 years, but they actually provide access to significantly broader cash flows than can be seen by looking at the above chart.

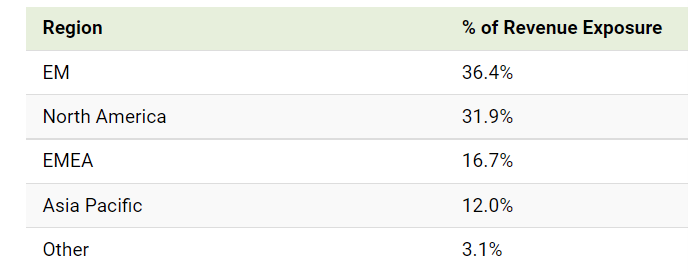

The table below highlights the underlying earnings that the US stock market generates and the countries from which these earnings arise. Surprisingly, the largest proportion of underlying earnings comes from emerging markets and Asia.

Source: Visualcapitalist.com

It is for this reason that Tacit portfolios continue to have significant exposure to US equities. The types of companies that we own are very different to those that we owned 10 years ago as the global economic environment has materially altered and the opportunity in the less well researched areas of the market provide significantly better risk/reward characteristics than the names currently in the headlines.