Share this post

What should you worry about as an investor?

October, 2022

A member of the team came across a list of annual financial and geopolitical events going back over a century which many investors may deem life changing and ‘unprecedented’. In our view, the term ‘unprecedented’ is used more frequently than it should and implies that events could not be anticipated. This just is not the case when we look through history.

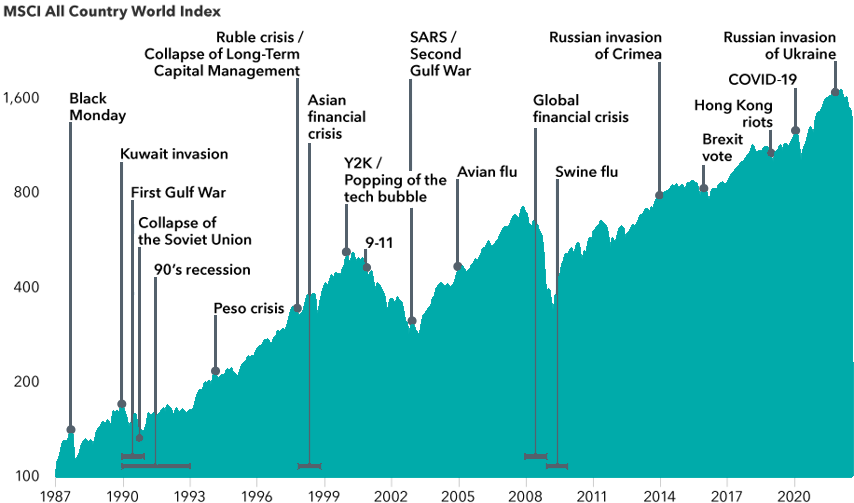

The chart below illustrates this point quite clearly. Over the past 40 years we have experienced both regional and global health emergencies, several conventional economic recessions, wars, terrorist attacks, and a banking collapse as well as many significant events that do not fall into any of these categories. It is actually quite sobering to plot them over time as in the chart.

Sources: MSCI, RIMES. As of 6/30/22. Data is indexed to 100 on 1/1/87, based on the MSCI World Index from 1/1/87–12/31/87, the MSCI ACWI with gross returns from 1/1/88–12/31/00, and the MSCI ACWI with net returns thereafter. Shown on a logarithmic scale.

Human behaviour is fundamentally skewed to worry about events which unsettle our sense of stability as emotion plays a significant role in human evolutionary development. The old saying ‘the more you have, the more you worry’ is an example of this.

The shaded area of the chart, a tenfold increase, is the return of global equity markets over the period in question. We could plot house prices and the chart would not materially alter. There have been lengthy and deep declines over time, but the reality is that markets rise over time as the cashflows that are generated in nominal terms grow, and therefore the equity (a stake in this cash flow) rises.

Falling equity prices have historically provided an opportunity for longer term patient investors. But these events pose the greatest threat to investors who have relied on short term outcomes and those who have insufficient other reserves to weather the turbulence.

One key difference today from 1987 however is that news is instantaneous. If an event occurs in Brazil, everyone with a smart phone around the world knows about it within minutes. Today, we have online portals that enable investors to monitor the value of their investments minute by minute, day by day. Anxiety is more prevalent today than it was previously. Unprecedented you might say!

In such as world it is vital to focus on what is important to you achieving your objective, and to resist being diverted by factors which are peripheral to your long term investment goals. It is also very important that investors assess their medium term cash flow needs to ensure that the periods when markets fall can be ridden out without becoming a forced seller.

The past five years have not been kind to most investors as many destabilising events have occurred concurrently. If history is a reliable guide to future outcomes, we should expect many businesses to survive and even prosper in the present turbulence, and for new champions of the future to emerge. Most of our clients have lived through the events highlighted in the chart above and know that their investments have produced the compound returns. Steadfastness and a focus on what generates enduring value are the keys to successful long term investment returns.