Share this post

US Hegemony

September, 2021

We have written many times about the dominance of US technology companies and how countries such as the UK, Germany and France have been left behind by the technological revolution of the past 20 years. But we do not believe it is only over the past couple of decades that competitors have struggled to keep pace with US.

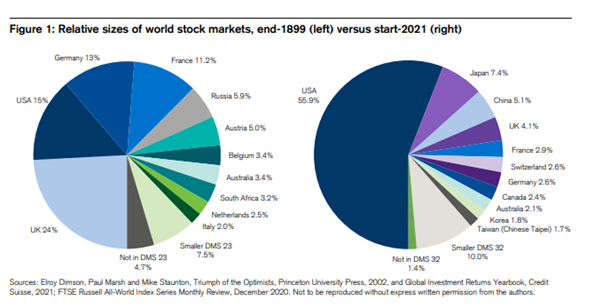

Using the value of listed companies as a measure of economic scale, the table below illustrates how over the past 120 years the US, through the power of its economy, and the stability and increasing dominance of its political position and of its corporations has become the leading country in monetising the global economy. It is truly astounding that the UK, Germany, and France, having represented nearly 50% of the global stock markets at the turn of the 19th century now account for less than 10%. The US, having been 15%, now accounts for over half of the global stock market.

The reason for pointing out these statistics is that investment is always about looking forward rather than looking back. Benchmark driven allocations to markets and countries are great for nostalgia but in reality, the investment dynamism our clients require to grow their real wealth over the longer term is more likely to come from areas that none of us currently know much about. It is highly likely the US will not dominate global GDP on the same scale in 20 years’ time, and the table above illustrates how the global economy (as represented by corporations) has changed, albeit over a long period.

It is also important to highlight that the US has benefitted not only from leadership in the development and commercialisation of technology in recent decades, but, most importantly, it has benefitted from the ability of its corporations to financialise its economy (and, though corporate acquisitions, those of other nations) into higher cashflows. These cashflows underpin the market capitalisations we have shown above.

Other economies around the world need to compete more successfully with the corporate dominance of the US, as any financial system that is so skewed to one country will result in higher risks than a more balanced system that prevailed in the 1800s. For the time being at least, only China can offset this dominance due to the size of its economy. The problem is that China does not measure its success through the capitalisation of the stock market as the US clearly does. Restrictions on foreign ownership of Chinese companies limit their ability to raise capital internationally, and that is another imbalance which has the potential to generate instability. China is still however the most likely economy and market that will contest the supremacy of the US, albeit over time.

We were fascinated by the sheer scale of the change in the above table and thought we would share it with our readers.