Share this post

The Value of Gold

November, 2020

The Stabiliser component of Tacit portfolios is very specifically designed to mitigate risks, both economic and market related, which may from time to time lead to a sharp correction in equity markets. Its components are primarily cash, G7 government bonds (both conventional and index linked) and Gold Bullion. These holdings are not held to provide a positive return, in fact, a small inflation adjusted loss in the Stabiliser component of our strategies should normally mean that our Growth component has provided above inflation returns and helped meet our clients’ objectives over the medium to longer term. This is the basic principle.

This is the structural argument on which our strategies are constructed. From time to time we need to adjust the Stabiliser component following a material change in market pricing and expectations. Going into 2021 we feel that this is one of those times.

Equity markets are driven by economic prospects into the future and liquidity conditions in financial markets. Over the longer term, it is economic growth and company earnings that matter most. However over shorter periods liquidity matters and this has been abundant from central banks over the past decade for various, in their mind justified, reasons: the 2008 financial crash, the Eurozone debt crisis in 2011, the Brexit vote in 2016, trade wars during the Trump presidency, COVID -19, and the list goes on.

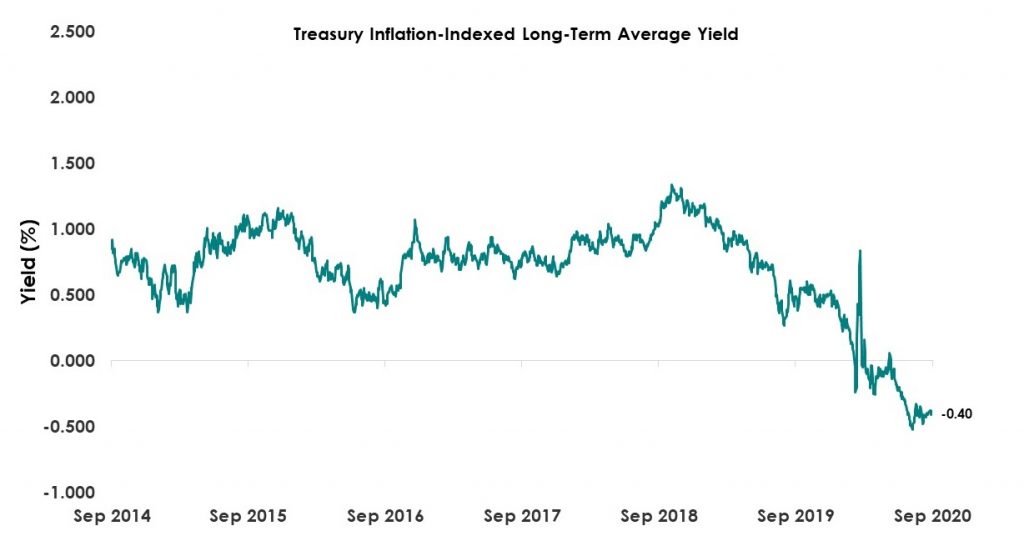

This liquidity stimulus, following 2008, is more commonly referred to as ‘quantitative easing’ and its impact on Stabiliser assets has been significant in the short term. The chart below shows the ‘real yield’ available from US government bonds. When the green line is above zero it shows that the yield (running income) available on a government bond is above the current projected inflation rate and, as now, when it is below zero it shows that the yield available if you bought this investment today is actually below inflation: i.e. you are locking in to a real loss and therefore eroding your capital.

The COVID-19 pandemic has pushed the one developed economy that still had positive real yields after 2008, the US, into the same negative real yield territory. In turn, investors have been speculating that Gold provides a true store of value in a world teetering on deflation, as it is finite in quantity and has been the ultimate store of value going back centuries. We do not disagree with this view, however it is not something we wish to speculate on at this juncture. In reality, Gold also has a negative real yield as it provides no income and relies entirely on price movement to generate a positive return. It has been the ultimate beneficiary of interest yields trending downwards, as shown above. In a positive real yield environment, investors will look at the ‘opportunity cost’ of holding Gold.

To us it seems more plausible that the recent efforts of governments, central banks and, most importantly now, pharmaceutical companies, provide for an improving economic picture over the short to medium term which will bring about a marked change in the relative valuations of different asset types, including Gold. This in turn will have an impact on how Stabilisers behave, and we must remember that Gold is a Stabiliser in our strategies NOT a Growth asset.

It is for this reason that we have been building a position in shorter dated index linked bonds into strategies (as these reduce the sensitivity to a reversal in the downward trend of yields as illustrated in the above chart) and we now have removed Gold from our Stabiliser. This is the first time in a decade that our strategies do not allocate to Gold, and although it is likely we will purchase this back at a later date, its role in our strategies has run its course for the time being.