Share this post

The Rubik’s Cube of Currencies

December, 2022

Few ideas in finance carry more confusion than currencies. It is not uncommon for senior international figures to mix up strength with weakness and get them totally the wrong way round.

The key thing to remember is that currency quotes are a “rate” not a “price.” As you will know from your trips abroad you always receive the lower rate when you buy your currency, and you pay the higher rate to turn it back to pounds when you return home.

Another source of confusion that by convention the US GBP rate (known as cable from the old transatlantic cables linking London with New York through which news of the 1929 crash was transmitted) is back to front – dollars expressed per pound as opposed to pounds expressed as dollars.

Confusion abounds.

However, currency markets are large and very liquid but what moves a currency against another can be entirely counter intuitive. Is the change in the exchange rate strength in the purchasing currency or weakness in the selling currency? Often, it’s hard to know.

But there are no free lunches in finance and currency markets are no exception.

A question we are asked occasionally is, “why can’t I buy dollars, convert them to Euros via Japanese Yen and turn them back into pounds to make a profit?” The answer in one word is, “arbitrage.”

There is a strict mathematical relationship between currency pairs and currency triads. If one moves, they all move.

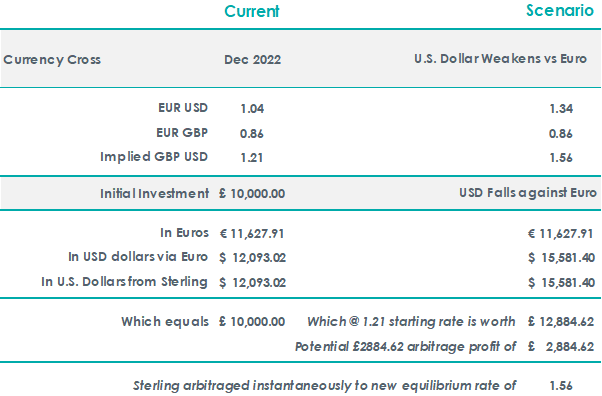

The, rather difficult, table below describes the process.

The current Euro Sterling and USD rates are shown. The table walks you through what happens, if as we think is possible, the recent bout of USD strength goes into reverse. Even though the outlook for the UK and its currency is fundamentally poor, the currency would strengthen against the dollar if the dollar weakened against the Euro all else being equal.

The Sterling rate falls out of the much larger swings in the Euro Dollar rate simply as a matter of mathematics.

If you work your way through the diagram (admittedly it would have to be a deeply miserable day to do so), you would see that if the USD fell from the current 1.04 Euro/Dollar rate to 1.34 (an entirely arbitrary number and emphatically not a forecast), the Sterling equilibrium rate on “Cable” would have to rise from 1.209 to 1.56 or the market would leave a risk-free profit of £2,884.62 on the initial £10,000 investment.

The market is never that generous and would arbitrage the profit away instantaneously.

The reason for currency hedging can be complex. In our case it is a function of a slowing pace of interest rate rises in the US leading to softer capital inflows into the US rather than a statement of confidence in Sterling.