Share this post

The Importance of Small Numbers

April, 2019

At Tacit, we focus on limiting drawdowns. With the risk of sounding trite, maths shows us that a focus on minimising losses can increase returns.

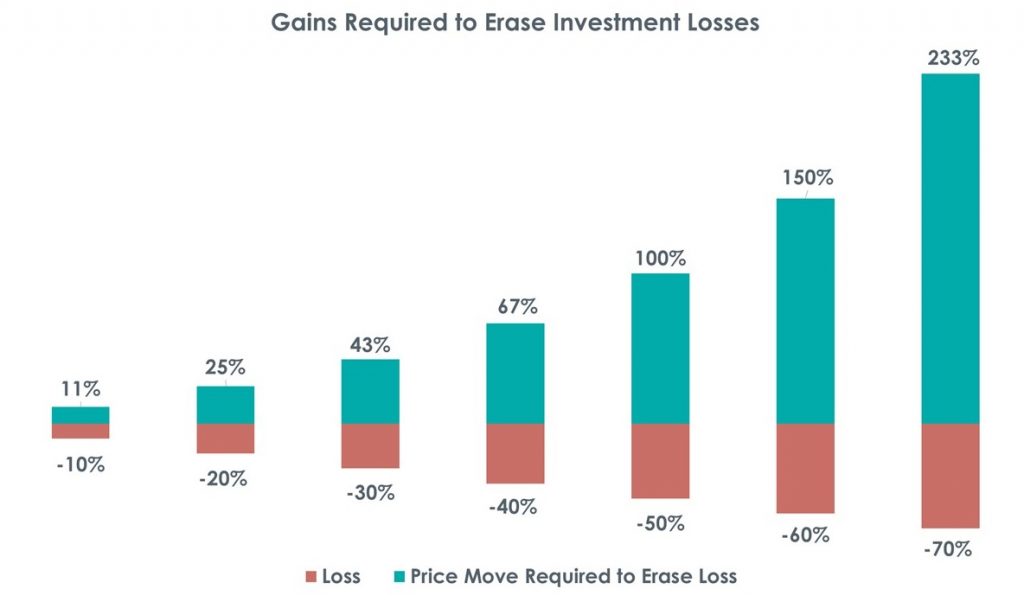

How? Let’s imagine you make a loss of 10% on an investment. In order to break even, you need to make back 11%. If you lose 40%, you need to make 67% to break even. If you lose 70%, you need to make back an astronomical return of 233% simply to get back where you started from. This is shown in the Figure below.

With every linear increase in the amount of money you lose, the amount of gain required to simply recoup the lost capital grows asymptotically to infinity. This is partly shown in the Figure above with the green bars (gains required to recoup losses) growing much faster than the red bars (losses). It is analogous to running a race where for every step forward you take two steps back. This is a losing strategy regardless of your level of conditioning or skill as a runner.

In investing, survival comes first and generating a return comes second. Survival comes from having a margin of safety – a gap between what an asset is intrinsically worth and its current market price.

Generating a return comes from either a closing of the gap between an asset’s intrinsic worth and its market price or by a growth in its intrinsic worth. Currently, most of our equity holdings are in companies where there is a gap between their market prices and their intrinsic worth. To make a return, this value gap needs to close.

Imagine after careful analysis, you buy an asset that has in intrinsic worth of £1 for £0.80. If it takes 10 years for the value gap to close, you will make 5% a year which is just below the long-term return of the UK equity market. If the value gap closes in 5 years, you will make 8% a year. If the value gap closes in 3 years, you make a sizable 11% return a year.

Human nature naturally focuses on big numbers but in reality, investing is about understanding that small numbers can compound to provide very strong returns.