Share this post

The Election, Inequality and Brexit

November, 2019

With the election nearing, we feel the need to provide you with a clear view on our thinking for portfolios in the event of one of the three core scenarios playing out: namely, a Conservative majority, a Labour majority or another hung parliament.

At Tacit, our focus is solely on the implications of the election result on the assets we own in client portfolios. The social positives and negatives of each Party’s manifesto do not drive our thought process other than their potential implications for the UK economic outlook over the medium term and its potential impact on the value of Sterling in the shorter term.

The past three years since the Referendum have led to a reduction in exposure to UK assets by both UK and international investors on a scale not seen since the early 1990s. This is understandable as the valuations of these assets were on a par with other major economies (other than the US) but the risks significantly higher. We believe that even though these risks have been largely priced into UK assets, given the recent political turmoil in the UK, they cannot be ignored.

But, and this is a very important but, the valuations of certain sections of the UK equity market have declined as the political and economic uncertainty has dragged on, and this is fundamental. The valuation of an asset today is a primary driver of future returns.

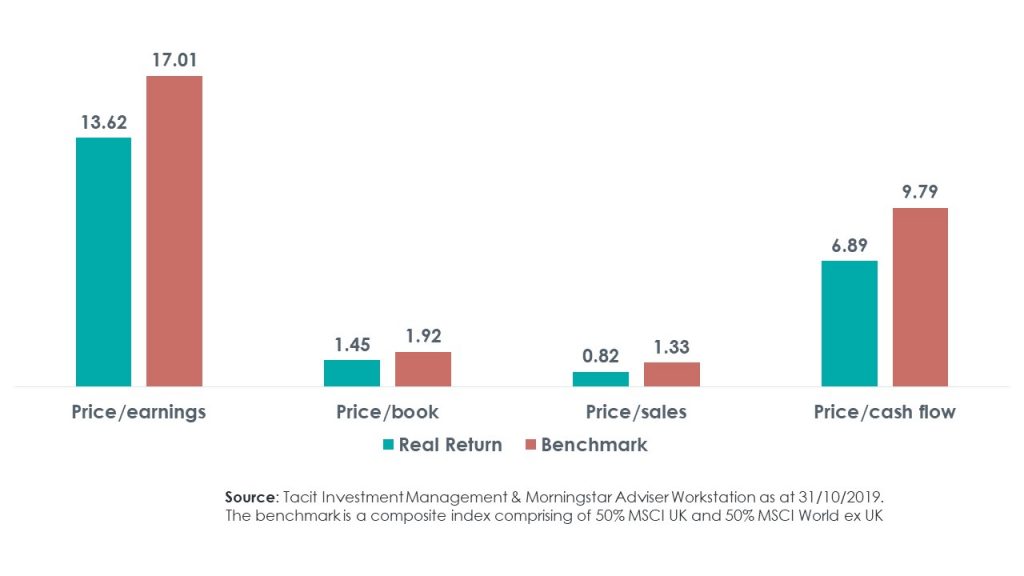

The chart below shows that the combined equity exposure in the Tacit strategies is trading at a significant discount to the wider global equity market, as measured by multiple parameters. This is extremely important as the largest exposures we have built up are in UK equities.

Our view for the majority of 2019 has been that the political stalemate in the UK will come to a head at some point and the calling of the election is the culmination of three years of disagreements between the major political parties in the UK.

The two scenarios we worry about most are a Labour majority in Parliament and a No-deal Brexit being forced through. Either scenario would have implications for our strategies and would result in a significant shift in our positioning. The two scenarios would be driven by either a clear statement from the electorate endorsing a return to significant state intervention and control, or that the UK should disengage totally from the European trading block at any cost.

All other scenarios, albeit uncertain, are trumped in our view by the extreme valuations of UK equities and the lack of ownership of UK assets by overseas investors.

It is vital to remember that events can alter the investment environment extremely quickly and we remain focused on outcomes rather than speculation. It is interesting that the UK equity exposure in our strategies has performed strongly over the past three months and we take this as an indication that market participants put the probability of one of the two extreme scenarios described above coming to fruition as relatively small.