Share this post

The difference between saving and investing.

July, 2023

Investor sentiment often fluctuates as financial markets oscillate through the elation of good times, (when investment returns are abundant and easy to come by), or the pain of bad times (where wealth has been adversely affected and investing can feel daunting and uncertain).

It is during these bad times, where short-termism can often lead to poor decisions about “where you put your money”, which impacts longer term wealth building aspirations. It is understandable to feel nervous, however, investors are usually compensated for the bad times in the long-run.

With the recent rise in interest rates it is tempting to turn to cash as a tactical investment choice. It is understandable, cash can provide peace of mind in bad times. However, the returns earned on cash savings are lower than the current rate of interest, and those that pay higher interest rates often constrain when you can make withdrawals, meaning timing reinvestment often lags market movements.

Cash is by no means risk-free. It can also decline heavily in real terms often struggling to keep up with inflation, meaning generally, cash savings are appropriate for goals that are less than five years where the erosive effects of lower and stable inflation on purchasing power are usually not felt.

The Barclays Equity Gilt Study has been published every year since 1955 and provides return data on UK and US assets dating back to 1899. This data is the bedrock of the Tacit investment approach and provides an unbiased view of how asset prices behave over both the short and the long term.

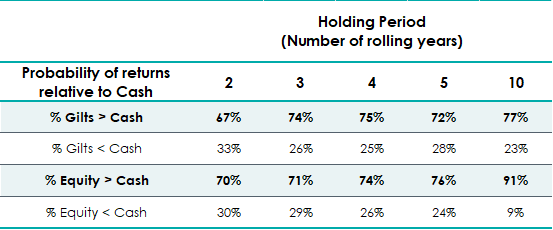

The table below shows the number of times gilts and equities outperform cash if held for 2, 3, 4, 5 and 10 consecutive rolling year holding periods.

During the past 123 years the world has experienced significant change and many challenges. In isolation, every period has its problems. The table above illustrates that irrespective of these events, both gilts and equities provide a consistently better return than cash if you are patient. Patience is harder to maintain in the modern world as more information is available to us on our phones at the touch of a button than would have been available to an investor reading any newspaper a hundred years ago.

Equity returns won’t necessarily beat inflation consistently either, but over time they should give you a better chance of keeping pace with it. The fact remains that the growing cashflows of companies will provide better returns than cash over time as companies use this cash to generate better returns from it. The need to invest is an individual one but history shows that holding cash in the longer term is as big a risk as holding investments in the shorter term.