Share this post

That was then

December, 2022

Income has historically provided a significant proportion of total returns over the longer term. For the past decade interest rates have been kept close to zero and this has distorted the income-seeking investment strategy. In such a low-yielding environment, an investment with a materially higher yield, say 4%, carried significant capital risks. In other words, yield-seekers were compelled to turn to lower quality investments which had to offer higher yields to attract capital.

History shows that all investments are priced off a ‘risk free rate’. When this rate is 0.5%, an investment paying 4.5% has a risk premium attached to it of 4%. This is because the value of your capital is guaranteed in the government bond yielding 0.5%. However, with an investment that is not backed by a government, there is a risk that your capital will fall in value as the 4.5% income return is not guaranteed. The ‘premium’ you are being paid is for the risk to your capital that you are taking. This risk may not come to fruition, in which case you would be compensated for taking this risk and would outperform the risk-free rate. If, on the other hand, the risk priced into the 4% yield did materialise, the value of your capital would fall, and your return would be lower.

We have recently made changes to our strategies which may appear at odds with the economic environment we find ourselves in today. High inflation, weak growth, and industrial action all around is not an environment in which we would normally feel more confident about the future returns of our strategies.

It is at times such as this we must remember that markets anticipate the future and move to price in the expected economic environment 6-12 months ahead of confirmation through the published economic statistics.

The primary reason for our confidence looking ahead is not because we can forecast better than others. In fact, we do not believe forecasting is a reliable or repeatable strategy when investing. We do, however, believe that the adjustment in risk premia we highlighted above has now provided our clients with an opportunity where they are being paid a risk-adjusted annual income (through dividends and interest) to remain invested and wait for market sentiment to improve without needing to take excessive risk with their capital.

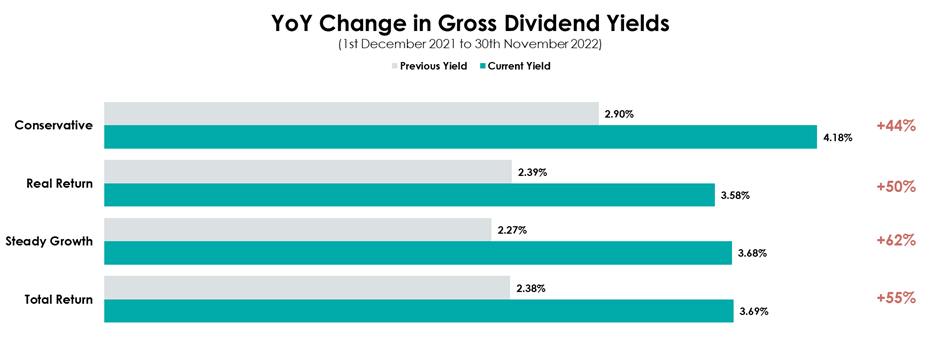

The chart below illustrates how the income yields of the underlying investments in our strategies have evolved over the past year and following our recent adjustments to the holdings within them.

Source: Morningstar Direct. Data is based on the model portfolio held directly with Tacit Investment Management. Charts for illustrative purpose only. Data as at 30th November 2022. Past performance, or any yields should never be considered a reliable indicator of future returns.

These income yields are at a premium to those available from cash, but also provide the prospect of significant capital upside from current pricing, whereas their prospective were lower and riskier a year ago. This is a very positive sign for the next market cycle as it is an indicator of positive real returns, albeit we cannot forecast when these will occur. Investors are now being paid to be patient without needing to embrace excessive risks.