Share this post

Strategy Update

November, 2021

Over the past few weeks, it has been difficult to ignore the increasing news flow around inflation and whether this is ‘transient’ or a more permanent phenomenon.

During 2020 we wrote at length about the impact of COVID on global supply chains and how this would impact the world economy in the short, medium, and longer term. In the longer term, building more resilience into supply chains will probably mean higher price pressures on certain goods. This however does not necessarily lead to higher inflation numbers in aggregate in the longer term as it is offset by the powerful disinflationary force of technology and innovation in sectors as wide ranging as finance to medicine. None of us can know for certain how these competing forces will play out over time, and we believe it is vital to focus on investing in companies that can grow revenues and cashflows during this period whilst many others are distracted by their balance sheet issues and looking backwards rather than forward. Sustaining ‘real’ cashflows through this phase ultimately provides a higher base to grow from when inflationary pressures moderate.

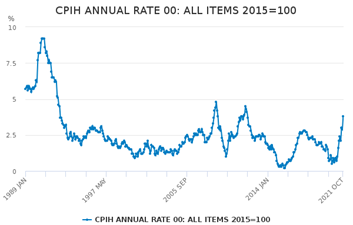

In the short term however, it was inevitable that inflation numbers would increase coming out of the pandemic. This was mathematically inevitable. The key is to remember that the current inflation rate in the UK, although high, is actually no higher than it was in 2011, the last time the global economy experienced an existential crisis and recovered. The chart below is taken from the Office of National Statistics and illustrate this point clearly.

At Tacit we have always believed that mean reversion is a powerful force in investment and the chart above illustrates this point clearly. So, whilst the headlines are about the short term, we remain focussed on the medium to longer term and have used recent market volatility to alter the regional exposures to equities in our strategies.

We have further increased exposure to overseas equities at the expense of the UK. Whilst the UK equity market remains attractively valued, Asian equities are priced on similar valuations and have significantly better growth prospects and offer a wider opportunity set across countries such as India, China, Taiwan and Thailand to name a few. Equity markets in this region were hurt by the onset of the Pandemic (as in the UK) and provide a unique opportunity of higher dividend yields, growing cashflows and strong balance sheets with low debt levels.

At Tacit our focus has always been on real returns and now more than at any time in the past decade we believe our strategies are positioned to preserve and grow real values over the coming years. If you wish to discuss the tactical changes, we have made recently please do not hesitate to contact your Investment Director or any of the team who will be happy to talk you through the details.