Share this post

Squaring the Cycle

June, 2021

The philosopher Friedrich Hegel observed that human society makes progress by moving from one extreme to another as it seeks to overcompensate for previous extremes.

This constant swing between extremes is just as natural in the investment world, albeit occurring on much shorter timescales. The primary driver for these swings in investing is, as ever, caused by human behaviour.

This cycle is perhaps best seen in commodity prices and businesses. As commodity prices rise (copper, as an example, is up nearly 100% over the past year), capital expenditure rises in tandem to meet this future promised demand. Naturally, too much optimism during the good years sows the seeds for the pessimism to come. An increase in capital spending and asset growth eventually creates excess supply which causes commodity prices to fall. As profits collapse, capital expenditure is slashed, and the industry starts to consolidate, causing a reduction in supply. Finally, a fall in supply eventually paves the way for a future recovery in prices and the cycle is complete.

How does one spot where we are in the capital cycle?

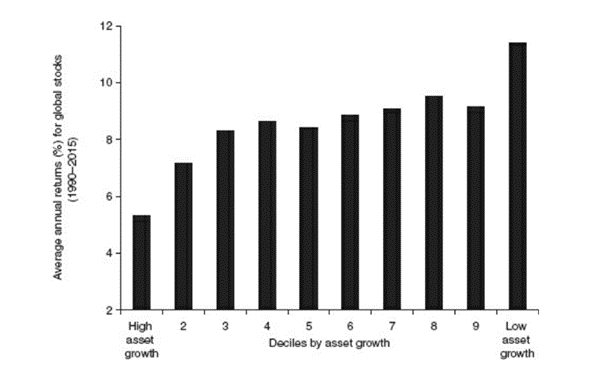

This is more of an art than a science but there are a few pointers. Firms with lower asset growth tend to outperform those with higher asset growth, as shown by work carried out by Société General shown below.

Source: Capital Returns by Edward Chancellor & Société General

At Tacit, our strategies are biased towards avoiding industries with excessive supply. Currently, these include persistently loss-making technology growth companies which have seen a large amount of capital flooding in. This group happened to be a great source of return in 2020, but more a source of loss and pain so far in 2021.

While there is potentially value in cyclical industries that have the opposite problem and have seen a dearth of supply, timing remains ever important. One could well make a 100% return in some of these beaten down industries but first you may well see another 50% drawdown. Mathematically, this leaves you at the same point you started at, except with a little less hair on your head perhaps.

Extrapolating the near 100% increase in copper prices over the past year would be foolish in our view but many investors are currently doing just that. As we wrote recently, the oil price has risen from below US$20 to close to US$70 today, but it fell from US$60 for no rationally predictable reason in March last year. Many investors will have lost heavily through those massive swings.

At Tacit, while we currently have some exposure to cyclicals which have performed well as the economy has recovered, the bulk of our equity holdings are in non-cyclical, high quality companies with a global footprint. This gives us some protection from earnings multiples contracting because the valuations of these companies are relatively low, compared to their steadily increasing cashflows and strong competitive advantage in their sector. Better, we believe, to invest in the steady and predictable than to speculate on the volatile.