Share this post

Picking Up Pennies in Front of a Steamroller

December, 2020

As investors we have a dislike of excessive company debts. Companies that have too much debt ultimately have to structure their balance sheets or go out of business. Or do they?

Corporate debt is priced off government debt. So if the government borrowing cost falls from 5% to 1%, all other things being equal, a company’s borrowing costs would fall from 6% (a 1% premium) to 2%. Therefore the debt servicing costs would fall by two thirds for this company making this a positive for its shareholders. However, if the company is deemed to be distressed due to its sensitivity to the economic environment, a pub business this year for example, its borrowing costs could stay at 6% as investors ask for a larger premium for the risks they are taking on.

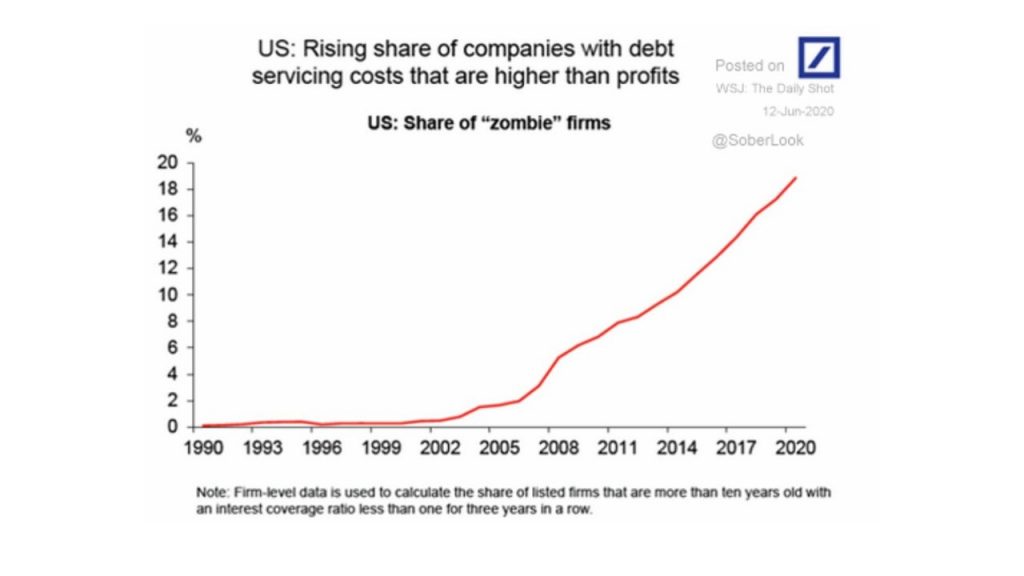

With interest rates falling to zero following the 2008 financial crash, even companies with weaker balance sheets have been able to refinance their debts even though their underlying businesses are not viable in the long term. Lower borrowing costs have meant that a company that may not have been viable when interest rates were 5% has actually been able to borrow and stay afloat as its borrowing costs have not actually risen in absolute terms even though the risks have. Such companies have come to be referred to as ‘Zombie’ companies.

The chart above shows that in the US, a proxy for the global picture in our view, these Zombie companies made up over 20% of all US companies. This number was below 5% coming into 2008 and had historically been near zero going back to 1990.

In the short term this is not necessarily an issue, however we remain concerned about how governments and central banks will reverse the interventions which have driven interest rates so low as it will lead to significant losses, both in peoples’ jobs and loss of investment. This is an asymmetric risk that we cannot see ending well because if the argument is that interest rates will stay low forever then this would mean that inflation is low and this in turn would mean that supply of goods and services continues to outstrip demand. Again, this leads to job losses and company failures. Either way, the exorbitant accumulation of debt over the past decades will hurt investors that own corporate debt at some point: be it through rising interest rates or through increased credit spreads due to a change in risk appetite.

2020 has hurt our relative performance as we did not own the debt of these companies whilst our peers do. We do not see the gains in corporate debt being repeated going forward, however, and we actually think this could reverse if the vaccination programs around the world underpin even a modest economic recovery over the coming years. Our exposure to equity in companies with strong balance sheets and the ability to take advantage of more difficult times for competitors provides a significantly better risk to reward profile looking into 2021.