Share this post

On Inflation

March, 2021

Much has been written about how prices of goods and services will respond to the sheer colossal scale of stimulus injected into the world economy by central banks and governments, all with the best intentions of staving off an economic collapse which would hurt livelihoods now and well into the future.

We would suggest that investors really do need to keep some perspective and to understand that for inflation to remain high for a prolonged period certain factors (commodity prices, wages, currency depreciation) need to become entrenched and this is unlikely to be the case based on history. More likely is a period of higher inflation immediately following the pandemic as restrictions are lifted, followed by a period of more of what we have seen for the past decade.

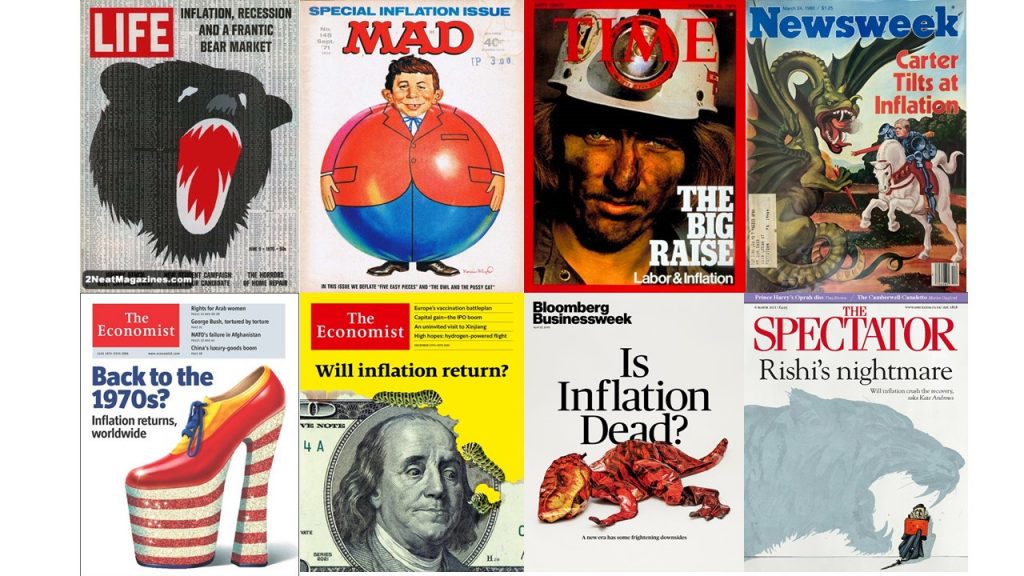

Some investors have an almost Pavlovian response to inflation. Any mention of the word and their attention is completely hijacked by the prospect of inflation and what it means for future returns. Inflation certainly sells. Below are a few magazine covers from the 1970s all the way to 2021.

The unfortunate truth is that predicting the magnitude and direction of inflation is a very difficult enterprise. Investors through the ages, many of them much smarter than us we would add, have repeatedly succumbed to the folly of trying to second-guess the Bogeyman that is inflation. Like Sisyphus perpetually cursed to roll a boulder up the hill only to watch it fall back down again, some investors just can’t help themselves when it comes to predicting and acting on macroeconomic trends.

In 2010, a long list of economists, well known investors and commentators were signatories to an open letter sent to then-chairman of the Federal Reserve, Ben Bernanke. The main point of the letter was to serve as a warning that the large-scale asset repurchase program, which later became known as quantitative easing, would risk uncontrolled inflation. Their pleas went ignored by Bernanke. Uncontrolled inflation did not rear its head during the subsequent 10 years.

At Tacit, our concern for our clients is focused on those factors that would lead to a large inflation increase for UK investors. Could inflation return with a vengeance globally? Certainly. However, most previous global inflationary rises have been short lived as supply and demand factors kick in to limit price rises over time. The scenario that must be considered for the UK is one that is similar to that of Germany post World War 1 when its currency depreciated resulting in localised inflation for the country.

The best way to protect UK portfolios from rising inflation is to limit exposure to long duration assets like long dated government bonds, property funds and expensive growth stocks, whilst also ensuring we have exposure to globally diversified revenue streams in the equities we own for clients. This is our current positioning at Tacit and it is no coincidence that our strategies have significant exposure to global managers at this stage as the importance of individual company analysis in the global context provides significant opportunities, whilst others are focused on the short term and trying to forecast the longer term.