Share this post

On inflation (and other matters)

October, 2021

It is hard in the UK to get away from the memories of the 1970s, when the government lost control of inflation, or the early 1990s when Black Wednesday occurred and the British government was forced to withdraw the Pound from the European Exchange Rate Mechanism (ERM), following a failed attempt to keep the pound above the lower currency exchange limit mandated by the ERM. Both episodes resulted in significantly higher interest rates for borrowers which in turn resulted in everyone being poorer.

We do not forecast that persistent inflation could not become entrenched again in the UK, however we place a relatively low probability on the current inflationary pressures in the UK being more than transitory at this stage in the economic cycle.

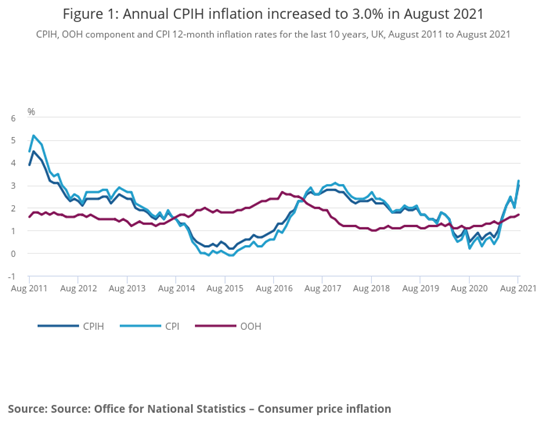

The Bank of England continues to believe that inflation will be transitory, albeit with a higher peak and a longer tail than they previously thought. This is unique to the UK in that we are dealing with the impact of supply squeezes on two fronts: the rapid reopening of economies from lockdowns and the medium-term readjustment to Brexit. Neither of these is solely to blame for the current inflation; both play a part in the UK’s almost unique position. The chart below shows that the UK inflation rate (blue lines) does tend to spike as economic growth rebounds, as it did follow the 2008 global Financial Crisis.

Global rates of inflation have fallen consistently over the past 30 years as the inclusion of China in supply chains, technological advances, and the reduction in the power of trade unions have all resulted in wage inflation being controlled. This was not the case in the 1970s. The significance of this is that it is excessive wage inflation that scars economies and leads to structural imbalances; the rising price of goods generally corrects as new supply responds to the pricing opportunity.

It may be that the period after the second world war is a better parallel than the 1970s for the issues we face today. Inflation surged in the US and UK at the start of the decade but fell quickly too as millions of soldiers in Britain returning to the labour market all at once resulted in rising unemployment and job shortages. The end of the pandemic has produced a similar dynamic, but one in which there appears to be a mismatch between the high number of advertised vacancies and the availability of appropriately qualified workers to fill them. A changing employment landscape takes time to bed in as people retrain for the jobs that are available today rather than those that were available before the pandemic.

Our Investment Strategy Group met to discuss these topics in detail recently and we have penned a note covering topics such as the China Evergrande property issues, progress with the Biden economic plan, wage pressures and the likely future direction of interest rates around the world. You can access this using the following link.

As we say above, we do not forecast the path of inflation, but we do see that it is important to remember the context of the current environment and not focus too much on any one region. Our portfolios remain skewed towards overseas earnings, even though the UK equity market appears cheap when compared to its European and US counterparts, which is crucial to balancing risk and opportunity in growth assets.