Share this post

On Inflation, Again

May, 2021

Equity markets have been volatile this week. Many have put this down to investors becoming concerned with increasing worries about higher inflation and how this will impact interest rates in the future. We do not buy into this narrative. We believe much of the current commentary around inflation is misplaced, as it fails to distinguish between a short-term technical surge and the beginning of a sustained secular trend.

The definition of inflation below is taken from the Oxford English Dictionary:

Inflation (noun): a general increase in the prices of services and goods in a particular country, resulting in a fall in the value of money.

Inflation metrics are calculated on both a monthly and annual basis. Investors generally look at the annual figure, since there can be a lot of monthly volatility. But what happens when the month you are basing your calculation on coincides with the onset of a global pandemic?

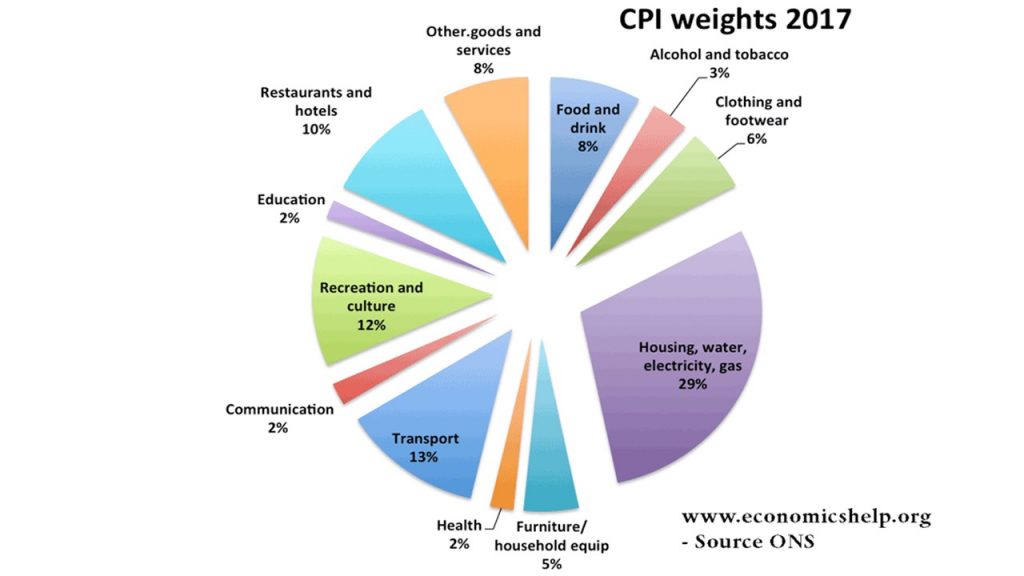

In 2020, prices fell in March and April and stayed low in May amid lockdowns and widespread business closures. And while prices soon began picking up, the annual increases this year will appear abnormally large as the figures are compared to the very low readings of last year. In the UK, as in many developed countries, the inflation basket of goods and services used to calculate this ‘general increase in prices’ evolves over time as an ‘average’ person’s consumption also changes over time. For example, in the 1970s a commodity such as Oil was a large factor whilst now restaurants and hotels are actually a larger component than food and drink.

To illustrate the difference between blips and secular trends, if the Oil price has risen now to $60 from $20 last year, this is a 200% increase, and if Oil is 1% of the ‘average’ inflation basket, then it has contributed 2% to the absolute inflation reading over the year. Now, what if the price rises to $66 over the coming year? In that case, its contribution is only 0.1% to the same basket the following year. This is where a concept known as “base effect” comes into play. The Oil price would have to continue to multiply year-on-year for a secular inflationary trend to take root.

At Tacit, the basic economics and mathematics lead us to focus less on the dramatic headlines in the press at present and more on the drivers of increases in prices: namely increased demand and reduced supply. There is no doubt that demand will increase this year and that supply chains have become strained as economies have shuttered at short notice. The question is whether this is sustainable in the medium term. We believe not, as technological change, the decline of unions and the sheer size of the global workforce provide a very strong counter-force to the short term demand/supply imbalances we are seeing at present.

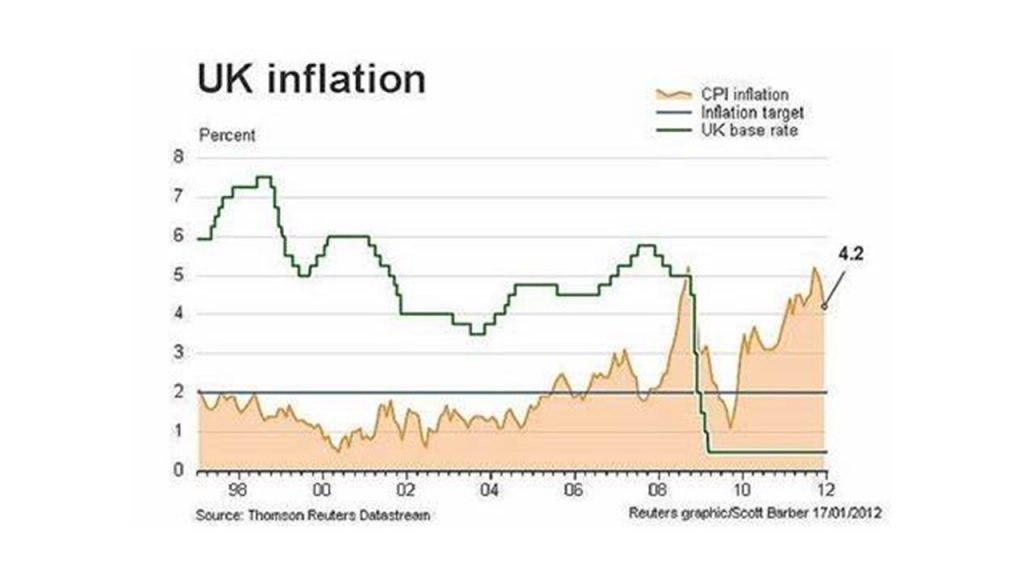

And to those that are expecting interest rates to rise to offset the surge in short term inflation, we would highlight the below chart published in 2012. At that time, inflation in the UK was over 4% but interest rates remained at near zero.

Just a reminder that investing is never one dimensional. There are many interconnected factors that must be taken into account before positioning a strategy.