Share this post

Not all bonds fall when interest rates rise

March, 2023

With interest rates rising, bond prices have fallen. Bond prices move inversely to interest rates: they rise when interest rates fall, and they fall when interest rates rise (as now).

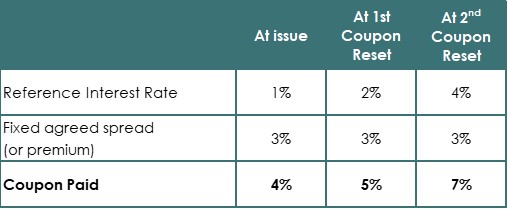

Since November our strategies have had meaningful exposure to a different type of bond in lieu of equity, namely Floating Rate Notes (FRN). FRNs, unlike conventional bonds, have a floating coupon that adjusts with changes in short term interest rates. Higher interest rates are actually good for the holder of these notes as illustrated in the table below:

Longer term clients will know that during periods such as now (2011 and 2020) we have allocated to company credit as the pricing has allowed us to generate equity like returns without taking on equity market risk. The opportunity in a diversified basket of FRNs at present is on a par with historic longer term equity market returns for three reasons:

- they generate floating income as shown above. FRN coupons reset in line with central bank interest rates. As interest are expected to remain higher, the running yield available is significantly higher than equity market dividends currently.

- They exhibit low duration. FRNs exhibit very low, sometimes no duration. This means that their capital value does not fall like conventional bonds when interest rates rise. This stable capital value is important when you are relying on the yield to generate returns.

- Current wide credit spreads. Due to the economic uncertainty around, credit spreads, the premium you are paid for lending to a company, are higher than at any time in the past decade other than during the Pandemic.

In the current environment we see an asset such as this as a very interesting alternative to equities. It is not a well-known asset but again illustrates why at Tacit we allow ourselves to invest wherever our research highlights an opportunity. This flexibility is vital during periods such as now when market distortions lead to valuation anomalies, which allow us to generate higher returns in the future without just buying equities to generate returns.