Share this post

Money illusion

March, 2022

Standard economics assumes that rational people base their decisions on real value only and take changes in price tags properly into account. For example, rational consumers are assumed to base their shopping decisions on “real” prices (e.g., how many hours do I have to work for a loaf of bread?) and would not change their consumption patterns if all “nominal” prices were to move in proportion (e.g., are inflated by the same factor). During periods of low inflation, this assumption may have some force; consumers are not under pressure to prioritise spending on one thing over another, as long as their overall spending pot can accommodate all that they wish to purchase. The resurgence of inflation over recent months has changed that dramatically, and many of us now have to prioritise our spending as may never have been necessary before.

Economists have only really begun to understand when so called ‘money illusion’ affects investment outcomes over the past few decades. It was commonly thought that the impact of irrational behaviour is limited in markets because “smart agents” can take advantage of irrational traders. However, recent evidence suggests that money illusion can affect markets and these ‘smart agents’ are actually prone to the same biases as the ordinary person in the street. Private investors, however seasoned, are no different.

The steady decline in inflation over the past two decades had made nominal values the focus of investors. Smart agents and private investors alike have turned their attention to companies perceived to have high growth potential and to the higher returns offered by higher risk and lower grade bonds. The global economic environment has changed in the past 12 months, forcing investors to evaluate their investments in terms of their ability to maintain real rates of return. Put in another way, inflation is running at a level such that it has become a hurdle for investment returns to reach if they are to meet the needs of investors.

Understandably, the question commonly asked by clients is: has my portfolio gone down in value? The relief of maintaining nominal values has overtaken the primary objective of investing: the preservation of capital in ‘real’ terms.

At Tacit our investment process has always been based on real returns, as our clients need to preserve and grow their purchasing power for the future, rather than chase the vanity of a short-term, double-digit return which is then given up during periods such as now. As so often, when risk and return are appropriately accounted for in portfolio strategy, the steady tortoise can make it to the finishing line after the frisky hare has dropped out of the race.

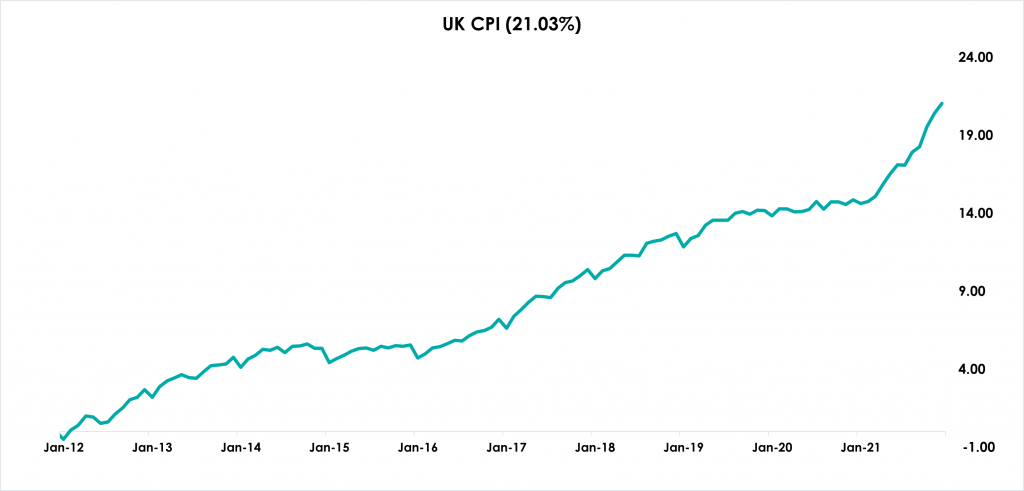

The chart below shows inflation in the UK over the past decade as measured by the Consumer Prices Index (CPI). A portfolio would need to have risen by over 21% to preserve its real value (not accounting for any potential income drawn down over the period). Cash would have returned less than 5% at best.

Source: Office for National Statistics, 10 Year UK CPI to 31st December 2021, retrieved from Morningstar Direct, 17th March 2022.

Our focus remains firmly on preserving the real value of our clients’ wealth first, with nominal values taking care of themselves over time. Hence for us, an index-linked bond, which links directly to inflation expectations, remains the risk-free rate we use to build stability and endurance into our strategies.