Share this post

Markets are doing what they do, we must keep our focus

July, 2022

A market is made of a buyer and a seller. If a seller hears that their main competitor has just gone out of business, you could not blame them if they put up the price of a good in their shop as their customers now have less choice in the short term.

Since late February this dynamic has been playing out in the commodity markets as Russian oil and gas and Ukrainian grains have been removed from sale by either sanctions or blockades of ports and land routes. The sellers of these items increased the prices of the commodities they had already bought to maximise their profits in the short term. This is simply market economics at play.

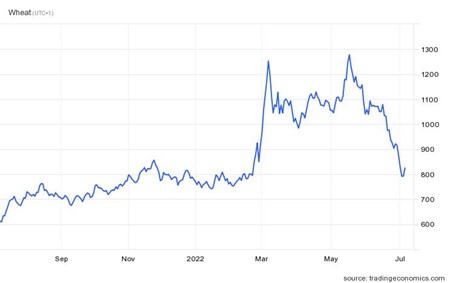

The chart of the wheat price below illustrates this short term phenomenon very clearly. It is interesting, however, how quickly this price gain has reversed even as the war in Ukraine has continued to disrupt supplies.

Wheat is not the only commodity which has experienced this price correction very rapidly over the past two months, oil prices are down 11% from their peak (in US$ terms), corn is down 35%, and copper has fallen 21%.

These prices have corrected through a mixture of substitution effects, where users substitute a good for a cheaper alternative, but – and this it the more telling point – through a reduction in end demand. This easing in demand is exactly what the US Federal Reserve wanted to see, as this was the intention when it began to raise interest rates earlier this year. It is for this reason that, although inflation may remain higher than we have become accustomed to, it is unlikely to remain elevated at these levels for long.

It is different for the UK and Europe as it is poor supply chains (again as with the Pandemic) rather than demand growth that are causing the inflationary pressures which will take longer to correct. This is a structural issue that will hold back growth in these economies and will not be fixed overnight.

The chart above is a good example of why investors should not extrapolate the recent past into a view of the future. Many prices can fall as quickly as they have risen. The recent pull back in commodity prices may well be forecasting a recession as demand has been curtailed through higher interest rates, but it is just as possible that they are illustrating a new balance between supply and demand which will reduce inflationary pressures in most countries quickly. Ultimately, it is real growth that will drive us out of the current predicament and the US and Asia are much better placed than UK and European economies over the coming few years to benefit from this.

This is not a Tacit forecast as many factors are at play in the global economy and can easily be joined by other unexpected forces, but the price movements speak for themselves, and we thought it an interesting analysis to highlight in a world where the cost-of-living rises are being extrapolated into perpetuity by many commentators.