Share this post

Manager Updates

March, 2020

Although we spend a lot of time explaining the economic picture and risks associated with equity valuations, an integral and important part of the Tacit Investment Process is understanding the funds we include within our strategies, and, most especially, understanding how each of the managers of these funds behaves at times of market stress. The experience of managing through difficult market conditions cannot be replicated in a computer simulation, nor can it be taught easily. With active funds, manager experience and how that manager functions in times of stress matters a great deal.

Although a relatively small investment company in the context of a multi-trillion pound industry, Tacit has direct access to all of the lead managers of the funds we hold and we have spent the past week in dedicated calls with them to get an understanding of what they are seeing from a bottom-up market perspective so that we can couple this with our top-down economic perspectives. Accessing these views in a timely manner can be vital to understanding what is driving price action in markets.

Here is an overview from the meetings which we thought you would find useful:

Aberforth Smaller Companies Trust

This fund invests in the smaller listed companies in the UK that are cheap and temporarily out of favour. It generally avoids deep-value opportunities i.e. companies with large balance sheet risks selling at deeply discounted prices. This is especially useful at this point in markets because highly indebted companies are increasingly at risk of defaulting as cash-flow comes under strain. At present, the fund has a dividend yield of 4.8% and the underlying portfolio of companies trades on a price/earnings ratio of 6 times.

Finsbury Growth & Income Trust

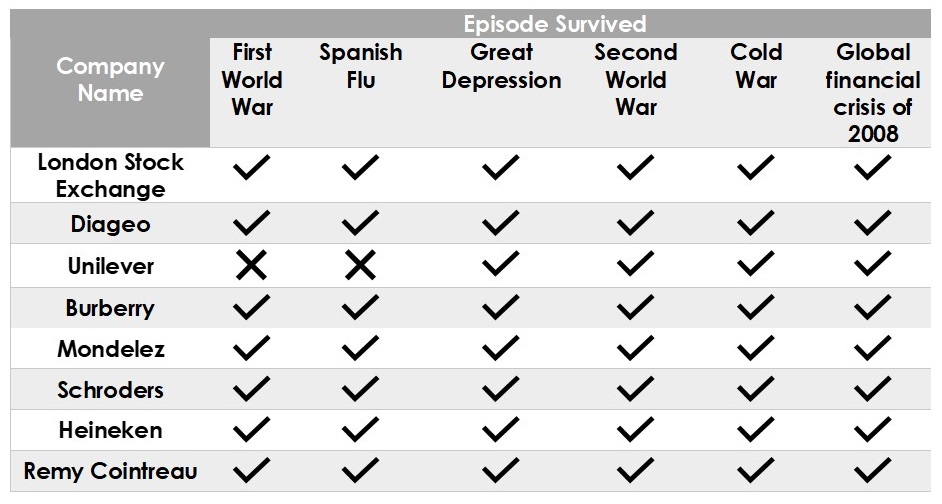

The trust invests in companies with exceptional staying power. Over 60% of the companies in the fund have survived several episodes of economic disruption. Some of these are shown below.

Some of the companies like Burberry will suffer a temporary drop in revenue as people reduce spending on luxury non-essentials. Importantly, Burberry has no debts to service and therefore can manage a short-term demand shock. However, some of the consumer discretionary companies will not see a significant impairment. Nick Train, the fund manager, pointed out that liquor stores in New York will remain open during the crisis. In the UK, Off-licences have also been added to the list of essential retailers that will remain open.

JO Hambro UK Equity Income

This is an income fund that invests in large and mid-cap UK companies and the managers have a dislike of financial leverage, as companies with excessive financial leverage have their very survival in question during periods such as this.

The fund does have relatively large exposure to the oil and gas majors – BP and Shell – which have both suffered share price declines. This was caused by a simultaneous drop in demand because of Covid-19 and a rise in supply caused by Saudi and Russia increasing production, most likely done to hurt US shale producers which are highly indebted. Prudently, the manager believes it is possible that some dividends may be reduced or cancelled during the period to preserve balance sheet health. For context however, this should not be too significant – even during the global financial crises of 2008, the dividend pay-out of the fund fell by only 8%. The fund currently has a dividend yield estimated at over 6% whilst government bonds yields are below 1%.

JO Hambro UK Opportunities Fund

This fund went into the crisis with about 20% of its portfolio in cash. They have held a large cash position for a few years now and have sometimes been criticised for it. However, cash is an option on future lower prices and the fund has been able to deploy some of that cash now at distressed prices. They have a similar approach to the JO Hambro Equity Income fund in that they avoid excessive financial leverage, so the survival of their companies is not a risk.

The key point we would like you to take from this week’s Thought is that the underlying equity exposure in the portfolio may have fallen over recent weeks but the managers believe there is significant value to be unlocked over the coming years. Access to real time views such as this is a vital cog in the Tacit process, and it is an essential aspect of our investment discipline to know that the underlying managers have stuck to their process through these difficult times.