Share this post

Luck & Skill

November, 2019

“Rise early, work late and strike oil” This was the success formula embraced by the American oil tycoon Jean Paul Getty. In most activities, there is an element of skill; working hard and becoming a specialist in some task will improve the likelihood of success. There is also an element of luck; this is what Getty termed “striking oil”.

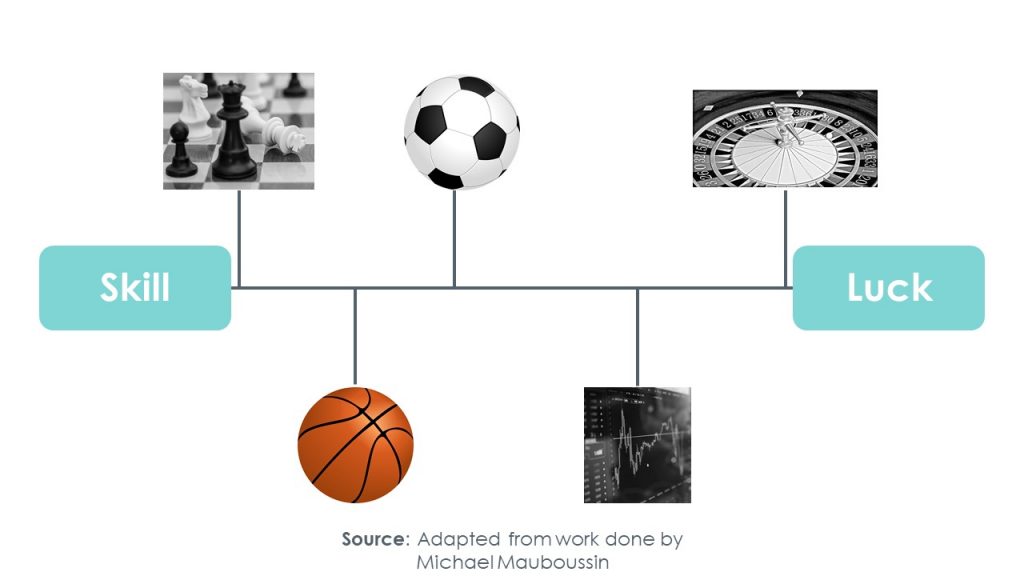

The outcome of some activities are entirely dominated by skill while others are entirely based on luck. Take chess or playing the cello for example – luck has no direct influence on the outcome of these activities, they are purely based on skill.

A game of football on the other hand sits somewhere in the middle of the luck-skill spectrum, albeit closer to the skill end of the spectrum. In the long run, a higher skilled team is likely to win more games in aggregate than a lower skilled team. In any single game however, a lower skilled team can beat its higher skilled opponents because of an element of randomness.

Mathematically, because of the low scoring nature of football compared to other sports, just one goal can change the outcome of a game. This is partly why world cup predictions relying on artificial intelligence and big data analytics often fail to predict the winner. Dollops of randomness in a single game cannot be accurately modelled by a computer.

The high scoring nature of basketball on the other hand makes it more impervious to randomness whereas a game of roulette relies almost entirely on luck.

The world of investing, in aggregate, lies closer to the luck end of the spectrum. In any one day, week, month, quarter or year, investment returns are not tethered to the skill of the investment manager or a superior investing process. In the short term, randomness usually plays a significant role.

There are only two ways of shifting the investing process towards the skill end of the spectrum. One of these depends on the investment manager and the other depends on the clients. As we explained in an earlier Tacit Thought, the most important risk management tool is the avoidance of harm or what Warren Buffett calls “avoiding catastrophic risk”. There is an entire class of investments that we avoid because the prior probabilities of success are very low.

One of the reasons for the collapse of Neil Woodford is excessive reliance on luck. He embraced catastrophic risk by investing in unproven (both scientifically and economically) businesses with large binary outcomes. Relying on luck is a bad investment strategy because “luck” is random. Good luck is a random event in your favour and bad luck is a random event not in your favour. Herein lies the trouble with trying to get lucky in investing – a 50% decline requires a 100% gain to simply get back to where you started. By not considering the possibility of catastrophic risk, a few unlucky events can lead to a permanent loss of capital.

From the clients point of view, the only way of decreasing the role of luck is to increase the time horizon. Just like in a game of football, a team with an inferior manager, process and players can beat a higher skilled opponent in a single game. In the long run however, a team with a superior manager, process and players is more likely to end up at the top of the league tables.