Share this post

It’s not just about China and India

April, 2024

Tacit strategies have a higher-than-average exposure to Asian companies as our analysis highlights that the valuations of many Asian businesses are significantly below their longer-term averages and therefore provide significant upside potential over the coming few years.

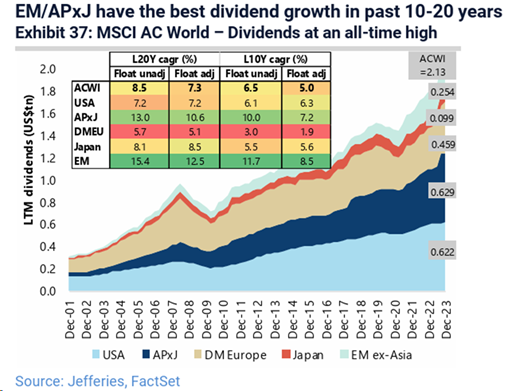

A second point for holding these investments is that the companies provide higher dividends than those available in the US, UK, or Europe and have been growing these dividends at significantly higher rates over the past 20 years or so. The chart below shows that the combined value of dividends from Asian companies (dark blue shaded area) is now higher than those from either the entire US or European equity markets. In fact, dividends have contributed over half of the total return generated by Asian equities over the past two decades.

The thesis for investing in Asia is not just about valuations or China and India, however. For example, over 50% of trade is conducted within the Asia region rather than with countries globally.

Interestingly, among the top 3,000 companies globally, Asian companies are most prevalent in the manufacturing sector. Specifically, the region’s strength is in industries like consumer electronics, industrial electronics, electric vehicles, and semiconductors.

For many Asian countries, manufacturing is the engine of the economy. In Asia’s largest economy, China, the manufacturing sector accounts for nearly one-third of economic output. In Asia’s 13th largest economy, Vietnam, it accounts for almost a quarter of gross domestic product.

Another fast-growing industry where Asian companies are thriving is in the consumer internet services space. Asia is home to half of the world’s internet users, which is driving innovation within the region’s online services industry.

Asia is a populous region with significantly younger populations than in Europe and the Americas, and therefore offers many opportunities which has different underlying drivers from other parts of the world economy. A recent McKinsey study split these into 5 distinct themes:

- Advanced Asia: High per-capita GDP, urbanisation, and connectivity. Includes Australia, New Zealand, Japan, South Korea, and Singapore.

- China: 18% of global GDP and population.

- Emerging Asia: Southeast Asia, strong regional connections, and trade. Includes Indonesia, Vietnam, Thailand, and others.

- India: 18% of global population but only 3% of global GDP.

- Frontier Asia: Limited integration, large populations and potential. Includes Pakistan, Bangladesh, Sri Lanka, and others.

The point we want to make is that Asian exposure used to be a small proportion of UK portfolios, but it now needs to be a core allocation due to its cheapness, dividend growth potential, and most importantly its underlying economic potential over the coming decade.