Share this post

Investing for the Long Term

June, 2019

Following a week where investors have begun to question long term investing and star fund managers, we feel it is important to provide some context.

In simplistic terms there are two ways to invest: either to be a longer term investor in assets or to be a trader in short term market moves. Both approaches have their merits and drawbacks but the primary factor that investors must consider when investing for the long term is patience. When trading, it is the ability of a fund manager to generate returns from market moves.

In the world of investing, absolute return funds (hedge funds) are managed by ‘traders’. You put some money in, the manager trades this based on their views and you hopefully get a desired output – a real inflation adjusted return.

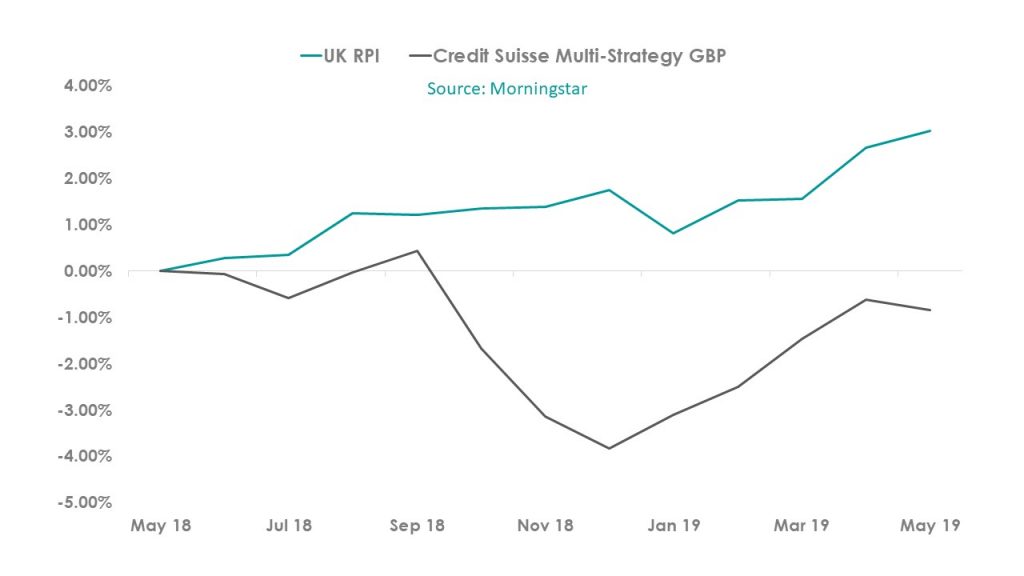

On average, absolute return funds fail to protect against inflation having lagged RPI since 2007. The Figure below shows the performance of an index of hedge fund returns over the last year. In aggregate, they failed to protect from the recent market sell-off.

Of course, you could get lucky and pick the best performing fund every year. However, because there is a swift rotation in the ranks, this is unlikely. The best performing fund in one year quite often finds itself among the worst performers in the next.

Poor performance largely comes from excess fees. The majority of absolute return funds charge an annual fee, front load fees, performance fees and exit fees. This sounds like a lot of fees for not a lot of performance. It’s no surprise that they fail to protect against inflation. Frictional costs add up and erode returns for the investor.

Timing which fund will do well in any given year is also challenging because you pay high fees for the privilege of jumping in and out of these accounts.

Most investors look at absolute returns funds as a place to park some cash and get a return in a low interest rate environment. Collectively these funds return better than cash in the bank. But you also stand the risk of making a large loss if you buy the wrong fund at the wrong time.

In conclusion, investing is not easy. Whether investing for the long term or trading market moves to generate a return, investment comes with risks. The key is to stack the odds in your favour when making decisions and we firmly believe that our approach does exactly this.

Our strategies are grounded in long term historic returns and we do not allow ourselves to trade short term market moves. Liquidity is also vital to our approach as our clients’ circumstances can change without notice and being able to trade investments is important at these junctures.