Share this post

Inflation is falling, just not as quickly in the UK

May, 2023

The inflation rate in the UK remains higher than in most other European countries. Interestingly, this is not the case in the US where inflation has fallen quicker and by more over the past six months. In fact, unlike in the UK and Europe, it is likely that the US inflation rate will be close to the 2% target very soon.

The US inflation rate is more important for investors than the UK rate (whilst the UK rate is more important to us all personally) as asset prices around the world are priced off the US government bond rate. A rising inflationary backdrop leads to a need for higher interest rates and this in turn leads to a higher US government bond yield.

The importance of government bond yields cannot be underestimated when investing. Government bond yields are important to investors for several reasons:

They set the risk-free rate: Government bonds are often considered to be low-risk investments because they are backed by the government’s ability to tax its citizens or print money to repay the debt. The yield on government bonds serves as a benchmark for the risk-free rate of return in the market. Investors compare the potential returns of other investments to government bond yields to assess their risk and potential rewards.

They provide an income: Many investors rely on fixed income investments to generate regular income. Government bonds provide a fixed interest payment (coupon) to investors over the bond’s duration. The yield represents the return an investor can expect to earn annually based on the bond’s current price. Higher bond yields indicate higher income potential.

They provide an economic indicator on the health of the economy: Government bond yields can serve as indicators of the overall economic health of a country. When bond yields rise, it suggests that investors expect higher inflation or anticipate a stronger economy. On the other hand, falling bond yields may indicate concerns about deflation or a weakening economy.

The valuation of other assets: Government bond yields indirectly impact the valuation of other financial assets. As bond yields rise, the relative attractiveness of other investments, such as equities or corporate bonds, may decrease. Higher bond yields can lead to a shift in investor preferences towards fixed income investments, potentially impacting the performance of other asset classes.

At present the inflation rate is driving government bond yields rather than strong/weak economic growth. After a period of very low interest rates, this has led to a rapid increase in interest rates which has in turn driven the valuation of many assets lower as they are not as attractive as they were relative to the risk-free rate. The US inflation rate falling rapidly is a positive sign looking forward as long as it remain under control.

At Tacit we do not forecast where inflation and therefore interest rates will be in the future. At present there is a healthy debate about the inflationary impact of climate change and increased tariffs between countries on the one hand and the disinflationary impact of technology and artificial intelligence on the other. Which will be more important looking ahead?

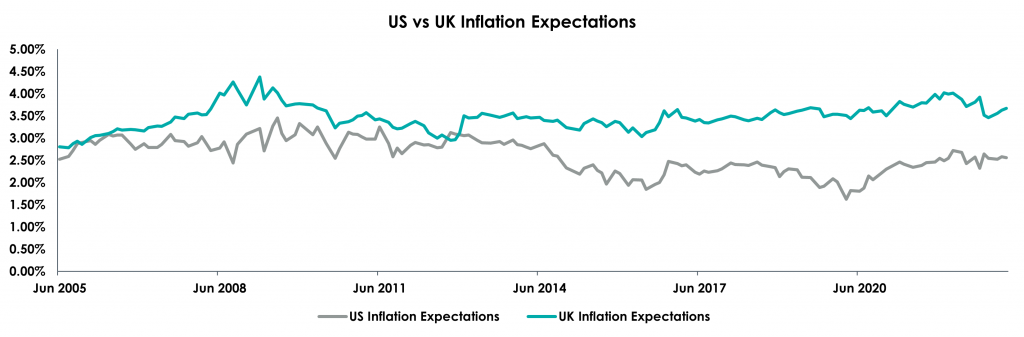

The chart below shows the current market longer term forecast for inflation in the UK (top line) and the US. Having risen last year, the expectations are for inflation to settle around the twenty year average moving forward. For the UK this may be achieved by constraining growth as at present whilst in the US it is more likely to be through innovation and energy independence. If the UK can innovate, there may actually be a positive surprise for us all in these numbers over the coming decade.

Source: Barclays Trading, IHS Markit, 5 Year, 5 Year Forward Inflation Expectation Rates for US & UK.