Share this post

Hidden Value

April, 2021

Since the Global Financial Crisis of 2008, technology companies have been the best performing companies in both developing and developed markets. At least that has been the narrative. A more accurate analysis of what has happened reveals something perhaps less interesting because it is quite obvious.

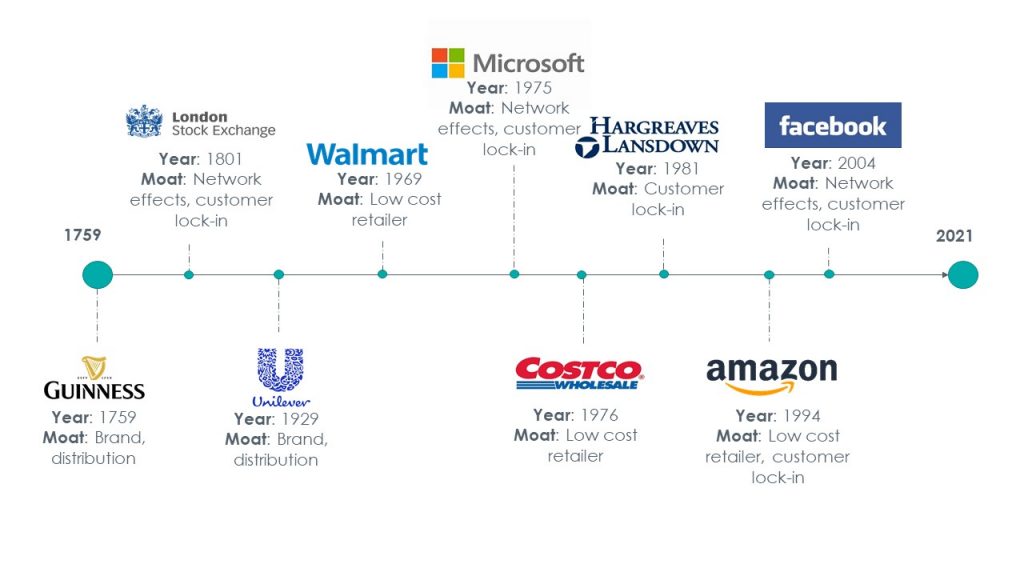

The companies that have performed well over the last decade all have economic moats – a competitive advantage that keeps the competition at bay. If we were to show you the long-term stock price chart of boring, non-tech businesses like Walmart, Costco, Dollar General, Greggs, the London Stock Exchange or Fevertree, you would be forgiven for mistaking them as tech stocks. What has allowed these companies generate high returns? A strong competitive advantage. And some have more than one competitive edge, which can increase their returns in often non-intuitive and nonlinear ways.

At Tacit, we don’t find it useful splitting companies into tech and non tech. What is technology, really? It is simply a technique, a way of doing something that is not apparent to everyone else at the time. Egypt in 3000 B.C, the pyramid’s architects, and builders, if incorporated, would have been the tech companies of the day. In Florence in the 1200s, it would have been companies that made fine woven cloth. In the 1600s in the Netherlands, the tech companies would have been shipbuilders and companies developing navigation techniques. In the 1800s in America, it was Carnegie’s steel mills which were pivotal for the railways and Rockefeller’s oil refineries.

The technology on its own is not actually that important. After all, aeroplanes were a pivotal technology but that hasn’t saved most airlines from bankruptcy as a result of rabid competition.

What is important is understanding how the technology creates a competitive advantage, be it through creating a strong brand, network effects, customer lock-in, distribution or low cost. New technology will come and go but these competitive advantages tend to endure.

Who would think that a company founded in 1801 would bare any resemblance to a technology company like Facebook founded almost 200 years later? Yet Facebook and the London Stock Exchange both enjoy the same competitive advantage of network effects and customer lock-in, even though they operate in different industries and were founded centuries apart.

At Tacit, our job remains the same. To find value wherever it may be hiding without arbitrarily boxing ourselves into an archaic way of thinking about technology companies. The only thing that matters is the competitive advantage that allows a company to earn super normal returns for years into the future while being tacitly aware (excuse the pun) about valuations.