Share this post

Hedging

November, 2022

For UK investors the performance of the Cable or Dollar Index has a significant influence over the risk and return characteristics of their portfolios which are typically priced in British Pounds.

“Cable “a slang term dating back to the mid-19th Century when telegraph cables were laid between London and New York to enable faster communication, is often used by forex traders to describe the exchange rate between the US Dollar and the British Pound.

This “Cable” rate has fallen from almost $2 at its peak in October 2007 to where it stands today at $1.19, having rebounded off its lows of almost $1.05 following turmoil caused by the mini budget.

But it is the behaviour of the dollar index during periods of market or economic stress that make it an important component of risk management for any investments held in portfolios which are invested outside the United States.

As the world’s current reserve currency, when financial participants become nervous, they hoard U.S. dollars at the expense of all other currencies. For a UK investor holding US assets during such a risk averse period, a rise in the U.S. Dollar reduces downside risks. In simple terms, if US equities fall by 20%, but the US dollar rises by 10% your loss is 10% (not 20%).

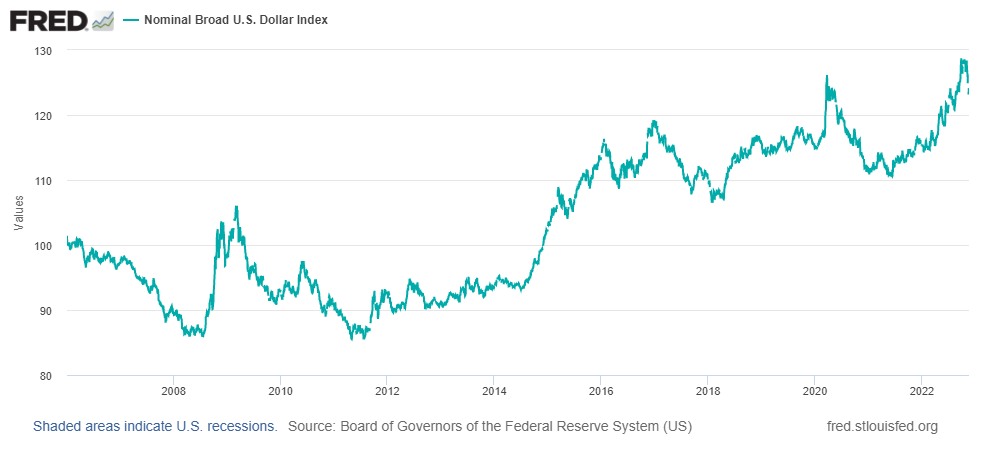

This safety premium can however also work against you, especially when investors are more buoyant and less risk averse. The performance of the US dollar index over the past few years has taken it back to levels not experienced for over 20 years, and we believe this has implications for UK investors moving forward.

At Tacit we believe that the U.S. equity and bond markets provide significant opportunities for investors which are not matched by other major stock or bond markets. This is driven partly by the depth of the US financial system and partially by the role of the US dollar we highlighted above.

It is important to note that although our strategies are heavily exposed to US assets, our latest analysis has led us to hedge (neutralise) a significant proportion of our exposure to the US dollar. This is the first time we have felt compelled to do this as it is not cost-free to hedge currencies. This is not a call on the merits or drawbacks of the British pound or the US dollar, but more related to the fact that we do not want to take a view over the coming years which is not founded in long term historical evidence.

The chart below shows the US dollar index over the past 30 years and illustrates why we have felt the need to hedge some of our U.S. dollar exposure at these levels.

Source: Board of Governors of the Federal Reserve System (US), Nominal Broad U.S. Dollar Index [DTWEXBGS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DTWEXBGS, November 23, 2022.