Share this post

Growth Opportunities

October, 2020

We recently wrote about the role of the Growth portion of our Stabiliser and Growth asset mix. The Growth component of the portfolio is ultimately responsible for, as the name implies, generating growth. It is mainly comprised of equities.

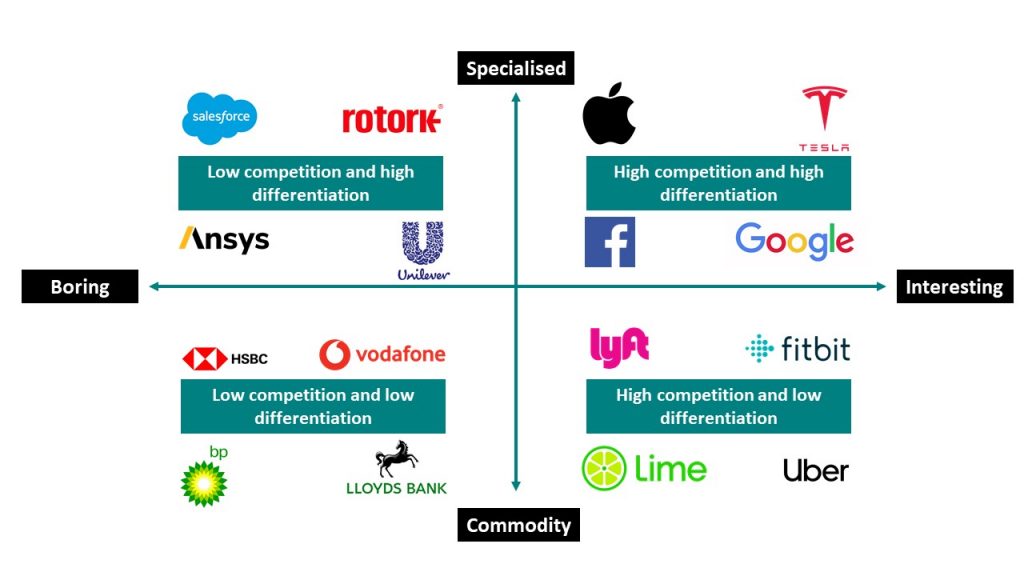

A good framework for evaluating the future growth opportunities of a company or an industry is to sort them into four possible segments as shown below, based on the nature of the problem they attempt to solve.

Whether a company or industry is interesting or boring is highly subjective. However, one can apply the dinner party test to roughly measure how interesting a particular industry is. If someone at a dinner party says that they are working on computer aided design software, audit software or specialist actuators used for transporting highly corrosive chemicals, chances are that person will not be the centre of attention.

However, someone working on self-driving cars, artificial intelligence, or green energy will likely be the centre of attention. To the average person, some problems are more interesting than others.

While this dinner party test may sound facetious, its underlying logic is valid. Smart, ambitious, and tenacious entrepreneurs try to solve hard problems that are interesting. Smart and ambitious employees are also attracted to companies trying to solve hard problems that are interesting. Naturally, companies in the highly specialised and interesting segment in the Figure above have a very high talent density i.e. a high number of exceptional employees as a percentage of total employees.

The specialised and interesting segment also attracts a lot of capital since the companies here are trying to capture potentially large future demand. A high supply of smart entrepreneurs coupled with a high supply of capital from investors trying to capture future growth equals tough competition.

It may come as a surprise to some seeing Google, Facebook, and Apple in this segment since these companies have very little direct competition today. However, at their inception, their respective industries were incredibly competitive and determining the winner in advance was far from obvious.

Take Google as an example. How many failed search engines preceded them? Alta Vista, Ask Jeeves, Excite, AOL Search, Infoseek, HotBot and Lycos, among others. Why did Google prevail? Probably a combination of superior search technology and luck. In an industry that operates with network effects, a slight advantage, be it because of pure luck or better technology, can lead to total domination and winner take all outcomes.

The main point we are trying to make is that picking the winners in highly competitive and highly differentiated industries is hard. From the present looking back, a naïve conclusion would be to say that the outcome was always obvious.

From the chart above, the worst segment to search for growth is companies that are interesting and undifferentiated. These are the growth traps where the promise of future growth never quite materialises. While demand may well be strong for their product or service, supply will be equally strong. High supply with limited competitive advantages and minimal differentiation is a formula for long-term wealth destruction.

The best segment to find low risk growth opportunities is the upper left segment i.e. the specialised, boring companies. They are often overlooked by the market so are usually available at lower valuation multiples. They are considered boring so there is less capital flowing into their respective industries, precluding the build-up of excess supply i.e. less competition. They are also highly specialised and can develop strong competitive advantages.

At Tacit, we are increasingly focused on this segment of the market. The biggest threat to any growth strategy is competition. Capitalism generally works and businesses with high returns on capital attract competition which drives returns lower. Overlooked and boring businesses operating in highly specialised niches have an inherent advantage.