Share this post

Finely Balanced

August, 2020

At Tacit we have spent the past ten years investing for ‘real returns’ and feel it is important to explain why this focus is so relevant at this juncture.

Investors often look at returns without taking the impact of inflation into account: a concept known as money illusion. Simply put, a £10 note in your hand is still a £10 note in two years but its spending power will have diminished over those two years due to price rises (i.e. inflation).

It is important to preserve and grow the purchasing power of your assets over time and an asset’s “real return” accounts for the inflation rate and more accurately describes the gain or loss on your investment. This is a key concept of economics as positive inflation expectations drive investment, whilst negative inflation expectations hold back investment. If you know something will be cheaper next year, then your £10 will be worth more in ‘real’ terms. If a company knows that the machinery it requires will be cheaper next year, it may put off purchasing it now, especially if demand is depressed due to an event like the Covid pandemic. These are all factors that have an impact on the economic cycle well beyond most people’s thinking on a day-to-day basis.

So why are we writing about this today?

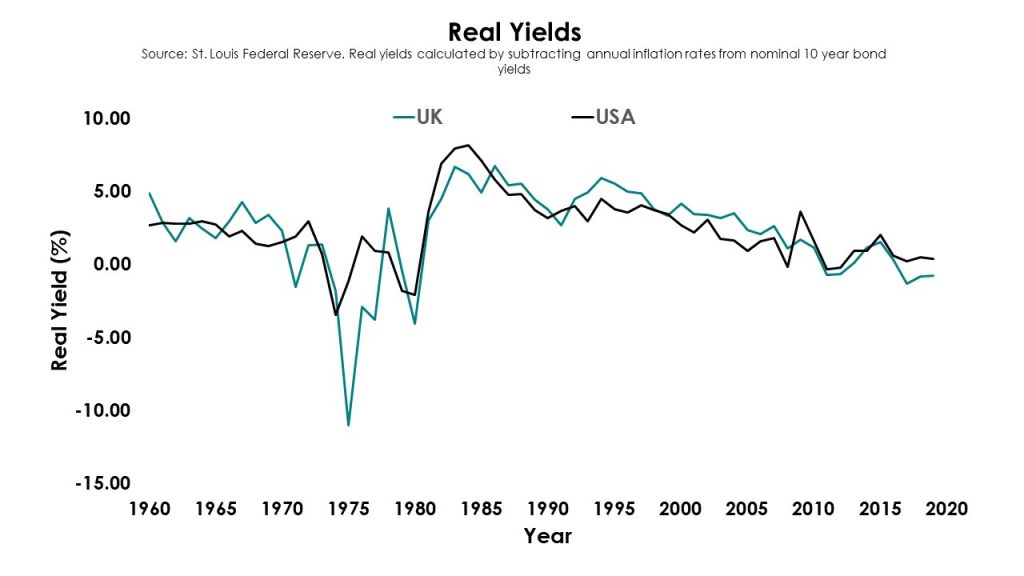

Well, real yields available from most government bonds, the quasi risk-free rate, are now below zero in the US, as well as having been negative in the UK for nearly five years. This means that investors are willing to sacrifice purchasing power over the coming decade to own these investments for the certainty of capital return that they provide. That points to a significant lack of confidence in the future value of other assets.

Yesterday, the US Federal Reserve altered its objectives from targeting a fixed inflation rate to targeting an ‘average’ inflation rate. This means that if inflation is below 2% for a period, they will allow it to run above 2% for a period. This was not a ‘lightbulb’ moment but more an acknowledgement that they have struggled to get inflation to rise to the 2% level they targeted for over a decade now.

The chart above illustrates quite clearly that the pattern of falling real yields on government bonds has been ongoing for nearly 40 years and is not a recent phenomenon brought on by the Pandemic or the Credit Crunch of 2008. In fact, it coincided with the Thatcher and Reagan led years from 1978 and 1979 respectively. Arguably, the driving force through this period has been the rise of globalisation and the consequent suppression of inflation though labour costs and ever-more efficient manufacturing and distribution modes.

In our view the investment environment we have become accustomed to over the past 40 years is altering materially without people acknowledging it. Increased protectionism and tariffs, higher government deficits and stubbornly high unemployment in many economies will inevitably lead to interest rates remaining low for many years to come. This is in essence what the US Federal reserve acknowledged yesterday, albeit in a roundabout way.

The key question to which none of us have an answer is whether this will lead to higher inflation or a deflationary period. Either way, the inherent risks in investment markets are higher today than they were a decade ago as the prices of most assets have risen materially during the decade and leave less return for the future.

Whilst many investors are focused on the pandemic as the issue at hand, at Tacit our thinking has moved beyond this to the longer-term ramifications for asset prices in the new environment.