Share this post

Elections

December, 2019

At Tacit, we have intentionally shied away from opinions on political events but we have been clear that the outcomes of these events are less predictable now than in the past, as social media and the now engrained effects of the financial crisis of a decade ago on economic disparity within countries have become more prevalent.

As an example, the unemployment rates in countries such as Spain and Italy remain above 20% among under 25s and this is a strong political force for change. It is important to remember that both of these countries are led by coalitions at present and have had similar issues to the UK with political instability over the past five years.

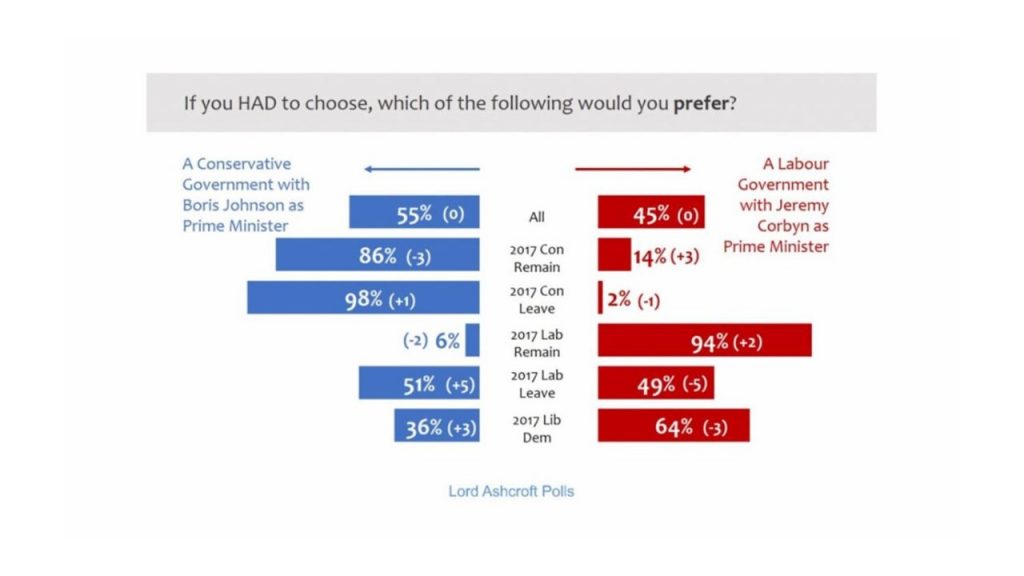

The UK vote to leave the EU was driven by many factors, some economic and others not so, and the election yesterday was a reminder that economic factors are not the primary driver in certain political decisions. The chart below illustrates quite vividly why the Conservative party gained a significant majority this time around. They held on to their Remain voters whilst many Labour leave voters have voted for them, or, voted for the Brexit party.

For investment markets, uncertainty is a problem. The result of the UK election removes an element of uncertainty for investors and the reaction of the Pound overnight (a 3% rise) illustrates how positive news can affect asset prices when they are undervalued.

In our view, UK assets are very cheap compared to many other developed economies, actually as cheap as they have ever been in relative terms, and we fully expect overseas investors to begin to purchase UK assets having been put off since the last election as they see a stable political environment unfold.

We are due to hold our quarterly Investment Strategy Group meeting on Monday and will further update you on our thoughts in next week’s Tacit Thought. As always, if you wish to discuss any aspect of your portfolio please do not hesitate to contact me or one of the team.