Share this post

Economic Moats

April, 2023

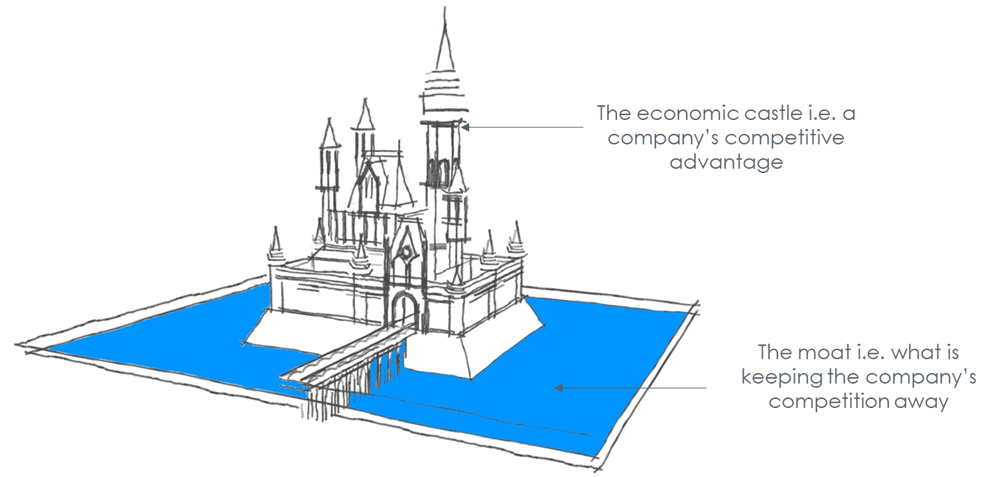

We have written previously about how certain companies exhibit a competitive advantage which makes it difficult for its earnings to be eroded away by a competitor. In the recent inflationary period, it is these companies which have been able to increase prices whilst not destroying demand in the process.

Microsoft, a common position in three of our portfolio holdings at present, is a good example of such a company. At its core, Microsoft is a technology company which produces software and computers. There are many software companies that do not exhibit the moat-quality we refer to above, so what makes Microsoft so resilient?

The company’s unique strength is that it has embedded itself in the way the modern world operates and it has a diversified product portfolio. Its flagship Windows operating system is used in more than 1 billion devices globally, it has a near 40% share of the cloud computing market which is growing at 30% p.a., its brand is recognised for security and stability, and it has a gaming business which you will now have heard of as the UK competition watchdog has blocked its purchase of Activision Blizzard (of Call of Duty fame).

The reason companies with competitive advantages are important is that they can maintain and grow their revenues in real terms during periods such as the last year without having to give away value to fend off competitors. They are also embedded in the fabric of living with the majority of their revenue derived either via a subscription (in the case of Microsoft), or via consumer habits as with Unilever (Dove soap) and Diageo (Guinness).

Microsoft published its results for the calendar year 2022 earlier this week. Despite a difficult economic environment, its revenues grew by 18%, earnings per share grew by 20%, and net income rose by 15%. The company’s share price has risen this year but is still down 15% from its high following falls last year due to investor concerns around interest rates.

At Tacit, we believe this is the type of investment that should be at the core of a portfolio and we have used last year’s falls in markets to increase exposure to holdings such as these as it is only a matter of time before other investors remember the power of compounding earnings growth at 15% – 20% year over year in an anaemic economic environment.