Share this post

COVID and The Housing Market

August, 2021

Record low interest rates, stamp duty holidays and a government guarantee for mortgages are some of the reasons behind the recent rise in UK property values.

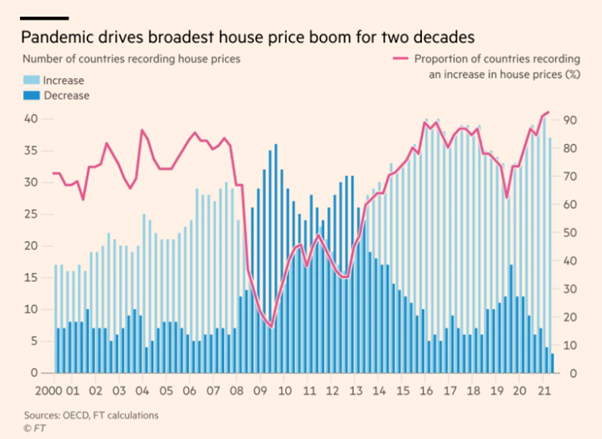

An emphasis on subsidising demand instead of increasing supply has naturally led to a substantial rise in residential property prices. This is not unique to the UK however as the chart below illustrates over 90% of OECD (The Organisation for Economic Co-operation and Development) are experiencing house price rises, the highest percentage on record.

During the global financial crisis of 2008, strict building regulations in the UK prevented an increase in supply of new builds, thereby limiting the after-effects of the housing bubble’s collapse. As a result, the British property market recovered rapidly after the financial crisis. During the covid-19 pandemic, supply side restrictions combined with the range of government subsidies highlighted above have led to surging house prices.

According to the ONS, prices have increased by 10.2% over the last year up to March 2021 – the highest annual growth rate since August 2007, before the financial crisis hit. The total value of homes sold in the UK is expected to reach £461bn this year, a 46% increase over 2020. This £461bn figure accounts for about 16% of UK GDP, not an insignificant sum.

In the US, a similar trend is also observed. The S&P CoreLogic Case-Shiller National Home Price Index, which measures average home prices in major metropolitan areas across the nation, rose 13.2% up to March 2021, the highest annual rate of price growth since 2005. The median price of a new home sold in April 2021 was $372,400, up 20.1% from a year earlier, the strongest annual gain since 1988. Inventory is down 37% year on year to a record low. The typical home sells in 17 days, a record low.

There are two main risks we need to consider as investors. First, a price reversal in residential property can hurt banks. Although cheap on standard valuation metrics like price to earnings (P/E) and price to book (P/B) ratios, banking stocks will be at risk of asset right downs in the event of a fall in property prices.

Second, consumer confidence can be negatively impacted since a significant amount of household wealth is tethered to house prices. This is especially true for mortgages with a high loan to value ratio. Such mortgages expose the buyer to excessive amounts of leverage which can magnify losses if prices fall. Now, most homeowners do not sell their property in this scenario, but in normal times their mortgage payments would be going down at the same time. This time it is unlikely, and mortgage payments may be going up as interest rates rise from their lows.

This of course is not a forecast on future house prices. It is impossible to forecast what will happen in the short term. In the longer term however, the liquidity pumped into the economy, record low rates and government guarantees on mortgages will change course and therefore we find UK banking stocks difficult to own even though they appear cheap on traditional valuation metrics. Our job is to consider the potential risks we see creeping up on markets which investors may have not experienced. This ultimately leads us to question whether interest rates in the UK can rise materially to provide a positive ‘real’ return due to the link between these and the mortgage payments of UK homeowners.