Share this post

Client Update Letter

May, 2020

18 May 2020

The team at Tacit felt that the current environment warranted a more in-depth assessment of the investment outlook, focused on recent events and, more importantly, on the changed investment landscape we foresee following the health-driven emergency that has dominated the first quarter of 2020.

Firstly, we hope you, and your family, are healthy and coping with the new lifestyle and environment. The Government’s actions have been taken for the good of us all, but we understand the difficulties that draconian limitations on movement and contact have caused, both physically and mentally.

COMING INTO 2020

We have previously highlighted that, coming into 2020, our view of the economic cycle was constructive, driven by two primary factors: the US economic cycle being prolonged by interest rate reductions by the Federal Reserve; and the improved political environment in the UK following Boris Johnson’s landslide election victory in December. These two factors, coupled with the extremely cheap valuations of UK equities, left us more favourably skewed towards equities for the first time in nearly two years.

The concerns we continued to have were that economic growth remained very low in most advanced economies even though interest rates have been near zero for over a decade in Europe, increased trade tensions being stoked by President Trump, and the general increase in Populist political agendas around the world. Add to this the high levels of corporate debts in the financial system and all did not seem rosy enough to us to be overweight in equities even with government bond yields near zero.

Importantly, all of our strategies were invested in equities that were trading at significantly cheaper valuations than the broader markets. This reflected our prevailing caution and would normally provide some buffer of resilience from falling equity markets should they arise.

THE PANDEMIC

The impact of the current pandemic is being felt by most of the global population. From an economic perspective, the primary factors that are important to note are:

- Moving on from an economic standstill globally with re-opening in phases. For the global economy, which has become more interconnected over recent decades, this has created a shock that has implications for international cash flows and flow of goods on an unprecedented scale.

- As this is a new virus, the immediate concern of most governments has been the control of the spread to prevent health systems from becoming overwhelmed. Finding a vaccine or treatment has become a secondary issue.

- The cash flow squeeze that followed the progressive closure of the global economic system has led to a squeeze on the US$ as most trade is conducted in this currency. This has further exaggerated the economic pain being felt and has led to a wave of unprecedented economic stimulus being injected into the global system (in an almost identical fashion to 2008, but on a greater scale).

- Our most economically sensitive holdings in our strategies that were most exposed to this shock were the JO Hambro UK Equity Income fund and Aberforth Smaller Companies which have both fallen materially this year.

- Stabilisers as a counterpoint have risen.

- The importance Tacit places on liquidity has once again proved effective in allowing us to manage the downturn whilst many assets we do not own, such as property funds and structured products, either did not allow trading or prices were not being made.

LOOKING THROUGH TO THE OTHER SIDE OF THE PANDEMIC

In terms of asset price implications, some or all of the following look probable:

- The damage to the productive capacity of the global economy will not be permanent but will be long lasting. Nominal GDP growth will be weaker than otherwise expected and debt servicing will become problematic for companies and individuals.

- Interest rates will be shackled to the zero bound for the foreseeable future and lower economic activity, higher unemployment and weak income growth will act to constrain inflation, but also consumption, making it harder for businesses to secure profitable margin growth.

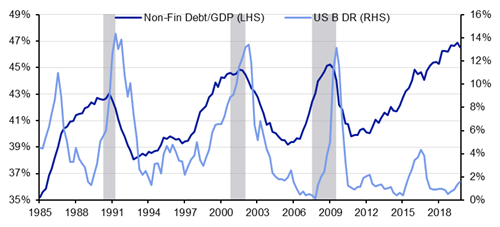

- The recent “business school” love affair with corporate debt at the expense of equity is likely to end. Adding leverage to a balance sheet may be “efficient” in a general equilibrium financial model but it adds risk to otherwise viable companies. As the banks were forced to raise capital after the financial crisis to reduce financial risk by strengthening their balance sheets, it is probable that companies will do the same this time around. We expect to see rising default rates alongside corporate deleveraging over time.

- We also anticipate an increase in equity issuance as companies seek to build resilience into their balance sheets This will constrain future returns on equity but it will result in safer businesses and modestly higher returns than is available from the “risk-free” rate. There will still be an incentive to invest.

- Company dividends will be reset lower. It is a truism that in the long-run companies cannot deliver dividends in excess of earnings growth. If the rate of return on invested capital is low, as is implied by zero interest rates, then shareholder returns will be lower-QED.

- Equally, as the very positive impact on the environment becomes clear as a result of the lockdown, we expect to see an accelerated “green agenda” take effect which could transform the shape of the economy, providing commercial opportunities for health, infrastructure, energy, entertainment and leisure.

- It is likely that deglobalisation will continue; just-in-time supply and manufacturing techniques will decline in importance and logistics chains will be shortened and re-ordered. If globalisation supplied a vast, low-paid, largely Asian workforce delivering high added value goods to highly paid Western consumers at low prices, the reverse is likely to be true also. This transition poses clear risks to global pricing and the global inflation rate in the longer term.

THE RISKS

You may have heard of the term ‘Cash is King’. During what is likely to be a prolonged period of adjustment for companies and governments alike, cash and liquidity are going to be vital to ensuring businesses can survive to prosper when the economic environment improves. This is a material risk to many companies that are in rapidly altering sectors, such as retail and leisure. It is likely that many brands will survive, as they have through previous downturns, but their shareholders and creditors will incur significant losses in this period.

These losses occurring is just one of the problems: the size and extent of these losses could also have a secondary impact on the financial system as a whole. This destruction of capital may well be what is required for the global economy to be placed on a more solid footing post the 2008 financial crisis. Trying to avert this risk is very important to avoid the permanent impairment of capital.

A further potential risk surrounds the US$ itself. Having been the world’s major trading currency for 100 years, the events of the past 10 years have made many consider what other approach could be taken to reduce the reliance of the global payments system on the US$. There is no simple answer to this: however, there have now been two major economic events which have hurt countries outside the US more than the US itself. This will provide a further push for emerging economies, Asian economies specifically, to consider alternative routes to managing their trading with other countries and could put strain on the current system. One for the medium term, but we believe that the Pandemic has increased the risk in this regard.

OUR POSITIONING

The outlook is therefore one of:

- Lower growth rates

- Higher debt burdens, for governments, corporations and individuals

- Continued digitisation of the global economy

- Supply chains of goods altering

- Higher tax rates

- Lower economic returns and greater consolidation in industries

- A greater focus on sustainability

In such an environment, companies with strong balance sheets and experienced management teams will take market share whilst weaker companies will fail. A focus on sustainable cash flow generation is vital, with companies that exhibit this sustainability becoming more and more valuable to investors as low economic growth rates reduce the pool of investments that can provide positive ‘real’ returns.

We have adjusted the positioning of the Tacit strategies materially to position portfolios for this new environment. A focus on well-managed and conservatively financed companies, alongside exposure to the continuing digitisation of the global economy, will likely provide the best opportunity for growing the value of investments. This has involved significantly reducing our exposure to certain holdings whilst also topping up those that have been marked down the most.

This, however, does not come without risks, as noted, and highlights the crucial role of the Stabilisers in our portfolios. We remain cautious in the short term as the health crisis remains a present threat for us all and portfolio positioning reflects this. However, we hope this letter provides you with some more in-depth insight into the opportunities we see that can help grow portfolios in ‘real’ terms over the coming years. The need to invest to preserve the real value of assets has been further enhanced by the lowering of interest rates and the guidance from authorities that these will remain near zero for a prolonged period.

As in previous periods of market stress, we remain committed to communicating with you as openly as is possible.

We have recently updated our Terms of Business to simplify them and you can access these on our website. There is no change other than better defining the types of investments that can be held within portfolios.

The new online client portal now holds previous valuations we have issued to you since the beginning of this year for your ease of reference. If you are having any issues with accessing this information please do not hesitate to contact either myself, or one of the Tacit team, with any questions you may have.