Share this post

Cashflow Comes in Many Forms and Sizes

January, 2024

The Tacit investment process is biassed towards companies that exhibit strong cash flows and can grow these cash flows irrespective of the economic environment which prevails globally. This approach can lead investors towards defensive and dull companies which do not rely on strong economic growth for their business models to increase cash flows year on year. Examples of such companies would be Diageo and Unilever in the UK. These businesses provide goods to a growing global population and raise their prices broadly in line with inflation rates which leads to increasing cash flows for their businesses.

Where the Tacit approach is different is that we believe the technological advancement of the past 30 years has led to a new breed of company which can firstly, deliver strong cash flows now, while secondly, delivering significantly higher cash flow growth than the likes of Diageo and Unilever.

During the past 18 months as interest rates have risen investors around the world have questioned the valuations of technology companies as the era of zero interest rates was coming to an end. There is no doubt that the valuations of these companies increased partly because the central banks around the world had reduced the discount rate used to calculate the net present value of the future earnings these businesses would potentially deliver. This adjustment has now happened.

The focus now must return to the underlying fundamentals of these businesses and their ability to grow their cash flows year on year moving forward. These technology businesses may provide simple solutions which we all use in our daily lives today, and may be developing new technological products which will become the staples of expenditure in the future, or, as with Microsoft, may be using their existing dominant position in an industry to accelerate their cash flow growth with the use of AI driven technologies.

For investors, these businesses could be deemed as defensive as the manufacturer of Dove, Unilever.

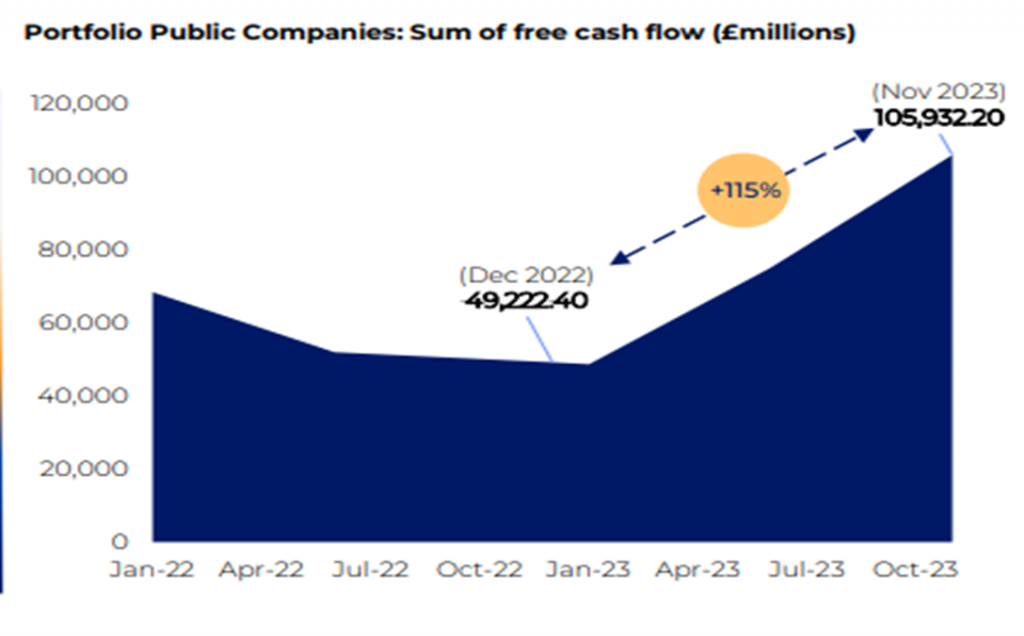

To illustrate this point, the chart below is taken from a recent presentation by the managers of a London listed investment company which has deep investment into the types of technology companies we are referring to.

The chart shows that the underlying companies within this trust have more than doubled their free cash flow; this is the cash flow generated after reinvesting into the businesses to maintain their existing revenues. This illustrates quite starkly how the business models of many technology companies provide cashflows which are not reliant on the global economic backdrop and can grow significantly in periods such as now.

The share price of this investment company was actually flat during the calendar year 2023 which has provided a significant disconnect between the underlying value of the investments it holds and the current market price of the trust. This to us is an example of how investors have thrown the baby out with the bathwater over the past two years.