Share this post

Buy and Hold

October, 2018

Investing is all about opportunity cost and unless you are re-investing your cash into growing a business, your alternatives are broadly limited to:

- Cash in the bank

- Cash under the mattress

- Bonds (corporate and government)

- Shares in companies

- Real assets (gold, property etc)

- Bitcoin, lion teeth, art and other esoteric assets

In the long term and on average, buying shares in companies has provided the best returns to investors. Of course you may have a cousin who buys and flips antique art or a nephew who swiftly made (and equally swiftly lost) money investing in bitcoin. It is entirely possible to make money by investing in other assets.

The two most important factors that determine how much return you will make is the price you pay and the quality of the asset.

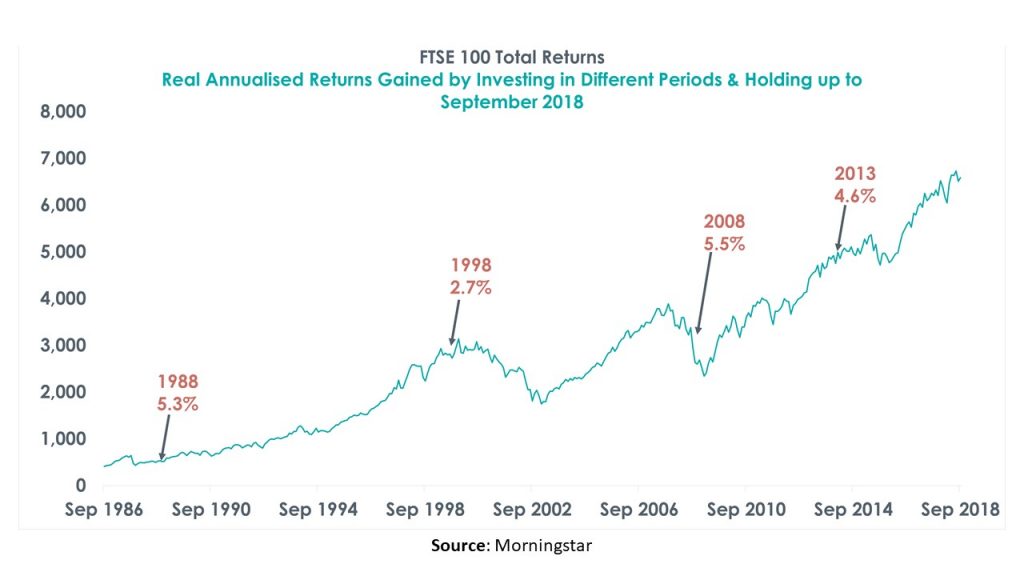

If you were to buy a basket of the largest 100 companies in the UK in 1988 and held it until today, you would have made 8.8% every year in nominal terms which is equal to 5.3% adjusted for inflation. The Figure below shows the real annual return you would have made by simply buying a basket of these companies at different periods and holding until 2018.

Of course you could have bought shares in 1988 and held until 2000 at the peak of the tech bubble and then bet on tech stocks falling. From 2002 to 2008 you could have invested in property and bank stocks as the housing bubble expanded and then pulled your money just before the crash and re-invested again as the market turned in 2009.

This is what many hedge funds try and fail to do as we previously wrote. All this thrashing about to find the next big thing and predicting when prices will fall and rise again have largely failed. Hedge funds in aggregate have not managed to beat inflation over the last 10 years. The people who work at these hedge funds are intelligent, hardworking and spend all their time focused on growing their clients’ money but often fail because of short term thinking. They are also seduced by complexity and often try to predict the unpredictable.

Investing in 2009 after the unravelling of the global financial markets required both courage and capital, both of which were in short supply precisely when they were needed the most. Uncertainty can however beget opportunity.

Currently, two uncertainties face UK investors – Brexit and the possibility of a Corbyn government. The outcome of both is important but largely unknowable. Our job at Tacit is to consider the opportunity cost.

We do this by weighing the price and quality of the assets we buy. One way we measure quality is by looking for companies in the UK with a larger portion of revenue generated internationally to protect against the uncertainties mentioned above. We measure cheapness by comparing the price we pay to get a portion of the cash flows generated by these companies and based on this metric, the UK is currently one of the cheapest equity markets in the developed world.