Share this post

Beauty is in the eye of the beholder

November, 2022

We’ve mentioned before that at Tacit Investment Management we don’t have a quantitative edge. This doesn’t mean we don’t use quantitative data in making decisions. An understanding of quantitative data in the context of history can provide very useful insights.

Most people compare the market today to the Dot-com bubble in 1999/2000 because they both involved internet and tech stocks. This is however not a good comparison. During the Dot-com bubble, speculative businesses were selling at speculative prices. Today, viable businesses are selling at speculative prices.

Take a look at this for example. The Nifty stocks of the 1970’s. They make a much better comparison to what is happening today.

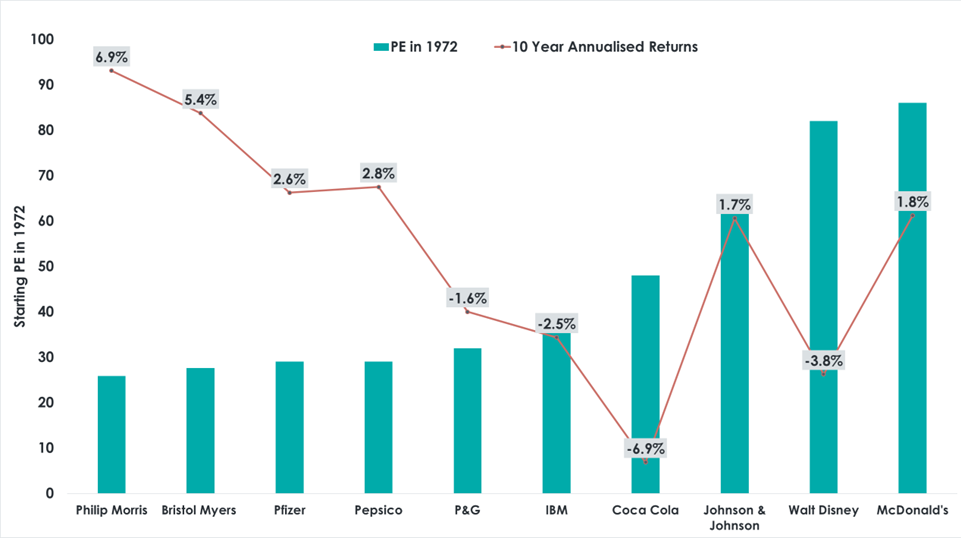

Here we have some of the Nifty 50 stocks and their price to earnings (PE) ratios in 1972 and the following 10-year annualised returns. Most of you will recognise these businesses because they still exist in 2018. How many of those involved in the Dot-com bubble are still in business? You know the answer without thinking.

What made these stocks attractive was their high earnings growth. However, as the Figure shows, overpaying for stocks no matter how good the business bears some risk. The relatively low PE stocks of Philip Morris and Bristol Myers delivered reasonable returns over the 10-year period. But the expensive high PE stocks offered poor subsequent returns.

Now focus on PepsiCo and Coca Cola. Both offer similar products and Coca Cola had higher earnings growth rates. But paying almost 50 times earnings for Coca Cola gave you -6.9% annualised returns over 10 years. PepsiCo was selling at 30 times earnings and the subsequent 10-year returns were 2.8%. Not great but significantly better than losing 6.9% every year.

With so much optimism priced into these expensive stocks, a whiff of bad news was all it took to send the prices down. The Nifty stocks did recover to give investors double digit returns over the longer term. But not many investors would have been patient enough to suffer 10 years of underperformance. Falling stock prices test the nerves of the best of us.

Some of today’s profitable tech stocks are better than the Nifty 50. They enjoy network effects and are capital light businesses. This does not however protect them from short term market concerns about the enduring nature of their profits during periods of economic distress such as now.

Ultimately investors can be fickle but, in our view, they will provide us with an opportunity to purchase these businesses at some point in the future at significant discounts to their longer-term profitability. Our analysis shows that this time has not arrived yet.