Share this post

An Opportunity if You Can See it That Way

December, 2020

As investors, it is vital we focus on the opportunities that a changing economic environment can provide to us as well as the threats it can pose. 2020 has been a difficult year for many reasons for many people. 2021 is likely to be better, following vaccine developments and some return to normality. The new normal however is unlikely to be the old normal for investors.

For our investment approach, 2020 has been a year in which many of the risks we worry about have become reality; however, the impacts on investment markets have been skewed by central bank interventions. As a reminder, this is the first time that the US Federal Reserve, the most powerful central bank, has bought up the debts of companies as a buyer of last resort. This is not sustainable over the medium term, as it is not economically realistic that the costs at which companies can borrow have fallen whilst debt levels have increased and default rates (companies not paying their servicing costs or principal capital) have also risen. This dichotomy will rebalance itself over the coming years as central banks must reduce their interventions to reset the balance.

The very positive point to have come out of this year will be that equity valuations have actually fallen for most companies, a fact which has been masked by the price action of a few global technology companies in the US. Even more importantly, we believe, the sudden and deep catharsis of the Covid shock will accelerate changes in consumer behaviour and corporate activity in many ways which will provide huge opportunities for companies that are positioned to take advantage of them.

A rising tide of economic activity following the savage contraction in 2020 will not be sufficient to lift all sectors and companies; there will be casualties, especially as emergency support measures are withdrawn, deferred tax bills fall due and, possibly, the cost of borrowing begins to rise. Strong companies are best positioned to benefit from the increase in global economic activity, but, just as importantly, they will grasp the opportunity to take market share from weaker peers and look to make tactical acquisitions of businesses in sectors that have good prospects in a changing world but which are struggling due to their mismanagement (rather than being a poor underlying business).

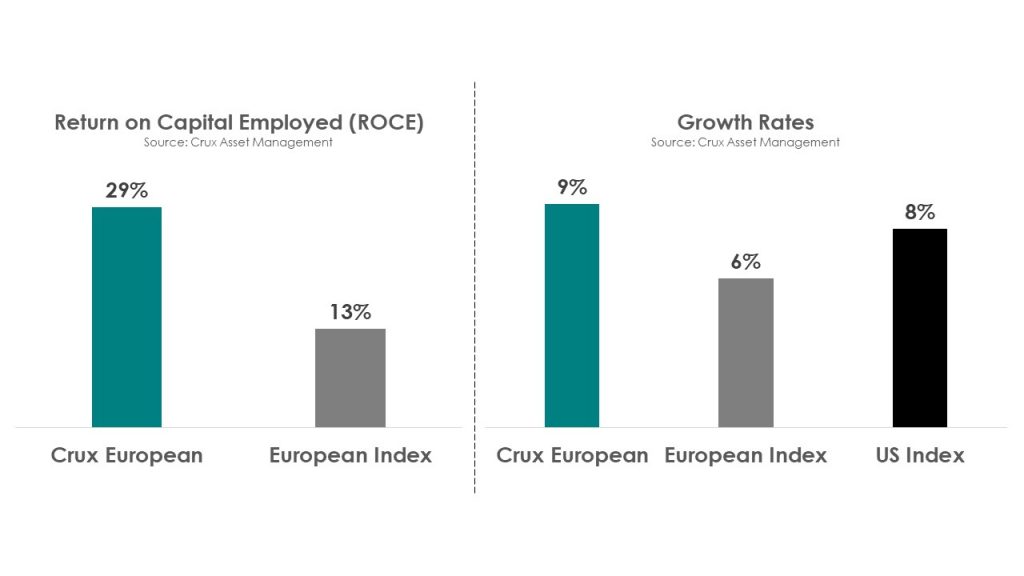

This is very exciting to us as there are many of these strong companies in our strategies which should have better growth prospects coming out of the Pandemic than going into it. The chart below illustrates how one of our holdings, Crux European, has a return on capital (ROCE) of nearly 30% across its portfolio, as well as superior growth prospects when you include the potential for accretive acquisitions coming out of the Pandemic.

The pandemic has driven down the valuations of such companies, often disproportionately compared to any economic headwinds they may face going forward. Therefore, a value gap has been created – a margin of safety, which increases the odds of superior returns.

It is for these reasons, among many others, we sense that emerging from the current economic and social misery will be a key period in most investors’ lifetimes, just as the period from 2009 -2015 was, following the financial crisis of 2008. Embracing the early stages of a recovery even before every uncertainty has been resolved, taking account of risk capacity and of your medium-term objectives, has historically provided strong real returns for investors, especially as interest rates remain anchored near zero in the developed world for some time to come.