Share this post

A New Gilded Age

July, 2020

During the gilded age in America, a few industrialists like John Rockefeller, Andrew Carnegie, Jay Gould, Cornelius Vanderbilt, and John P. Morgan, among others, had a strong hold on the American economy. In many ways, the companies they founded and ran were the tech companies of the day because they developed new and scalable solutions to societal problems and reaped the benefits of rapid growth and monopoly-like profits.

The Sherman antitrust act of 1890 aimed to limit monopolies artificially increasing prices by limiting supply. Its biggest victim was Rockefeller’s Standard Oil company which was split into 34 smaller companies. Standard Oil’s descendants still exist through ExxonMobil and Chevron.

Earlier this week, the heads of some major tech companies were hauled before Congress for an antitrust hearing. The CEOs of Amazon, Facebook, Apple, and Alphabet (Google) were questioned about past anti-competitive behaviour. These four companies, while often labelled as if they are a monolith, are actually very different. Apple escaped largely unscathed from the questioning compared to its peers since it does not monetise user data. Amazon has helped ease the pain of the quarantine by providing quick and cheap deliveries to its customers. Its cloud services also allow businesses to transition to a new way of working because of the pandemic.

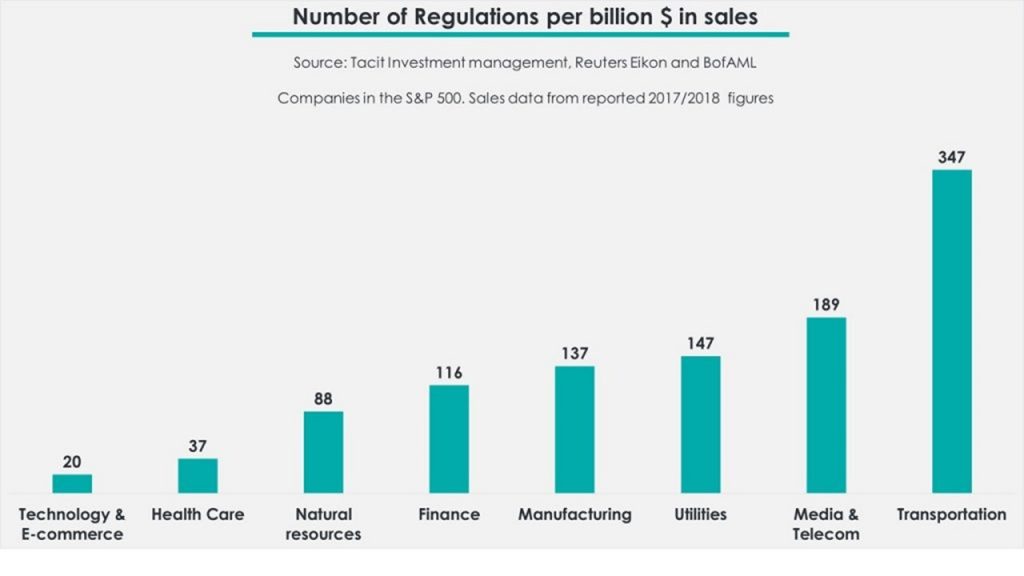

Just how big are these companies exactly? The combined revenues of the four companies in 2019 accounted for almost 4% of US GDP. The figure below shows the number of regulations for every billion $ in sales across different industries. Relative to their size, tech companies have very limited regulations.

The transportation industry is by far the most regulated industry. However, this was not always the case. The first traffic lights in New York were installed in 1920. Before that, the only regulation involved a traffic warden manually directing cars and pedestrians and occasionally yelling at careless drivers. Even something as basic as seatbelts were not a requirement in early automobiles.

Today, the transportation industry has the most regulations relative to the revenue generated by the industry – 347 regulations for every billion $ in sales. It is not hard to imagine a future where tech companies have more regulations relative to their size in the economy.

It is unclear how effective the coming regulation will be in monitoring tech companies and anti-competitive behaviour. So far, the regulation has been similar to a traffic warden trying to do the job of traffic lights and road signs – largely ineffective.

Our job at Tacit remains to be the stewards of your investments and not moral arbiters deciding what is good or bad for society. Companies like Facebook and Google that monetise user data probably have the most to lose from new regulations.

To quote Tom Wheeler, former chairman of the FCC – “the business models of some companies prioritize advertising velocity over factual veracity”. This can erode the value of truth and trust in a democracy and is likely to encourage the regulatory hammer striking the business models of these companies. While these companies have been largely immune to the pandemic, it is not clear that the regulatory risk they carry is being considered by investors.