Share this post

The Ick Factor

January, 2019

No it’s not a Simon Cowell spin off show. But it is something that gets our vote. The investment community regularly borrows language from the outside world. Take the word catalyst for example. It’s normally used in the context of a chemical reaction. A catalyst, in investor speak however, is an event that has a significant effect on the price of a security.

Some investors search for a catalyst before making any investment. While this can be useful, sometimes it’s just not necessary. Think about it. The combustion reaction occurring in your car engine doesn’t have a catalyst yet manages just fine without one. The valuation of an asset when you purchase it is often all it takes to make good returns.

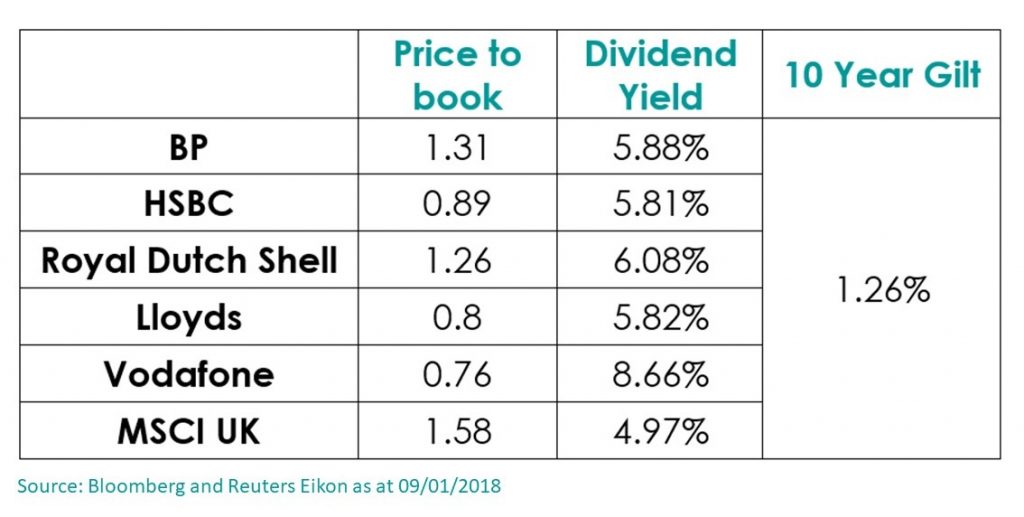

In investing, there are no certainties but with RPI currently at 3.2%, buying a 10-year gilt yielding 1.26% is one of those few perverse certainties that guarantees you’ll lose money in real terms. The ride may be smoother owning gilts but a trip straight to financial hell might not be worth the journey. At Tacit our focus is primarily on growing the ‘real’ value of our client portfolios and therefore we must embrace certain risks in the current environment.

The table shows the five largest equity holdings in the Real Return strategy at present.

The top five equity holdings all trade on par or slight discounts to the broader UK market, which is already on a mark down to global equity markets. They also give a stream of dividend income that yields higher than inflation.

The price to book value is a proxy for the liquidation value of a company and values less than 1.00 are indicative of cheap evaluations.

Compared to historical valuations, these companies are trading cheaply. And this is where the ICK factor kicks in with the sheer disdain in which some UK stocks are held by overseas investors. For example, some brokers in the US refuse to buy global oil companies simply because they are listed in the UK. If we look at BP and Shell for example, about 80% of their revenue is generated outside of the UK. Irrational herd behaviour of this nature begets opportunity.

With low valuations, solid balance sheets and a high current dividend yield, a specific catalyst is not required: sheer value will be enough over time.