Share this post

8012 Points

February, 2023

This week the FTSE 100 index reached a new all time high of 8012 points. This is a newsworthy event as, unlike other equity markets around the world, the UK equity market has struggled to make new highs since 2018. In fact, the index failed to trade higher than its level in 1999 until after the Brexit vote in 2016. This is a simplistic view as dividends are not included in the index value but that does not alter the new high reached this week.

Tacit strategies have been positioned away from the UK for the majority of the past decade as we have looked for higher growth overseas. So the question is: did it work?

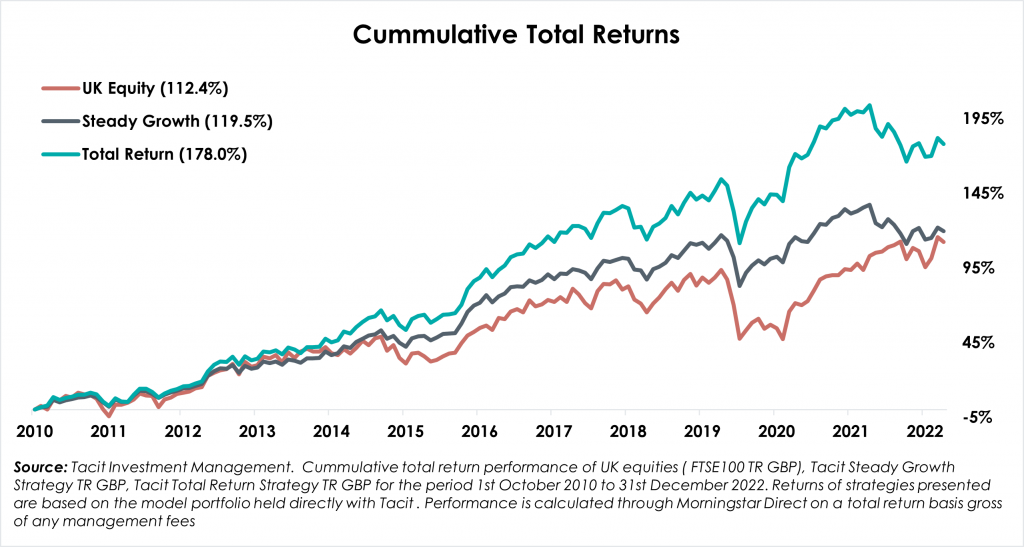

The chart below shows the UK equity market (with dividends reinvested) alongside our Total Return strategy (100% equity like for like), and also the Steady Growth strategy over the past ten years. Keeping it short, both have done a job. The Total Return strategy has generated far superior returns whilst the Steady Growth strategy has generated similar returns but with significantly less downside risk by falling less in downturns.

We thought this is a simple but interesting comparison as investors often question the need to diversify into global markets as this generally increases costs. We believe the above chart reminds us that nominal point records on indices, even the domestic index which has no portfolio exchange rate risk, can hide a multitude of sins.