Share this post

Bursting the Bubble

February, 2020

Investing in the public markets, you get frequent appraisals of your holdings. The daily fluctuations in prices though have nothing insightful to tell you about risk, they are the value a buyer puts on a particular investment at that moment in time.

Business schools and much of the finance industry measure the fluctuations in prices – the volatility – as a proxy for risk. Think of how absurd it would be if an estate agent told you that a particular property was a risky purchase because of monthly price volatility.

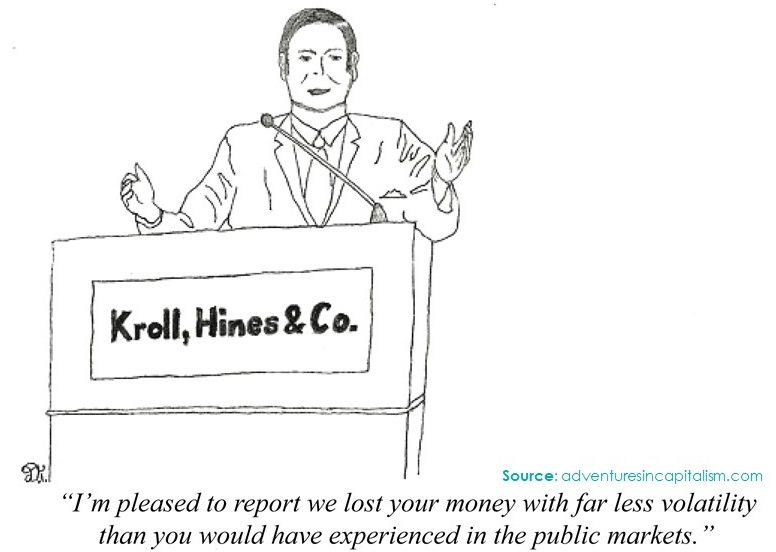

Private equity is different however and herein lies the problem. An entire generation of finance experts and countless complicated equations taught in business schools have primed the minds of most investors that volatility is synonymous with risk. Following this logic, one can reduce risks by simply reducing volatility. This is what most private equity and venture capital funds have seemingly achieved.

Unlike publicly traded stocks and bonds that fluctuate in price based on the price buyers and sellers set, private equity firms use mark-to-model accounting to value positions. Whenever there is a sale of an asset, the valuations are marked up or down (mostly up) and the fund reports a return. This makes returns less volatile and following the logic of risk management taught in business schools, supposedly less risky.

However, many of these fast growing “disruptor” type companies held by the private equity firms are not profitable. Therefore, they must raise more capital to achieve scale. This means more mark-to-model accounting and more opportunities to lure investors into supposed low risk, high return investments. Recently, things have started to unravel and we believe this is an interesting example of how a company which appears low risk on the surface can actually be very risky when looked at through a different lens.

WeWork, the company offering shared office spaces, fell by almost 80% after years of fictionally inflated mark-to-model valuations. This company was once deemed low risk because they had low volatility and dependable cashflows but it overstretched itself and got into financial difficulties at exactly the wrong time: when it was trying to float on the stock market.

Ultimately, just as the share price of a listed company can get overstretched, so can the perception that other private companies are low risk because they are not marked to a price a buyer would be willing to pay today.

Over a decade of low interest rates has only exaggerated this problem and we find it very difficult to understand how these companies will behave if interest rates rise or, more likely in the short term, investors increase their return requirements when lending to such companies. WeWork was just an example but shows how risky a low volatility investment can be.

This is why we believe that there are very few low risk assets available to investors, and private equity is definitely not one of them.