Share this post

2018 through the rear-view mirror

January, 2019

A turkey that has been cared for by a farmer for the entirety of its life has no reason to think that same person will kill it for food one day. The turkey looks at life through the rear-view mirror and its concept of the future is limited to what has happened in its recent past. As most of us probably had some turkey over the Christmas holidays, it is clear to see that looking to the recent past for clues of what the future will bring has its limitations.

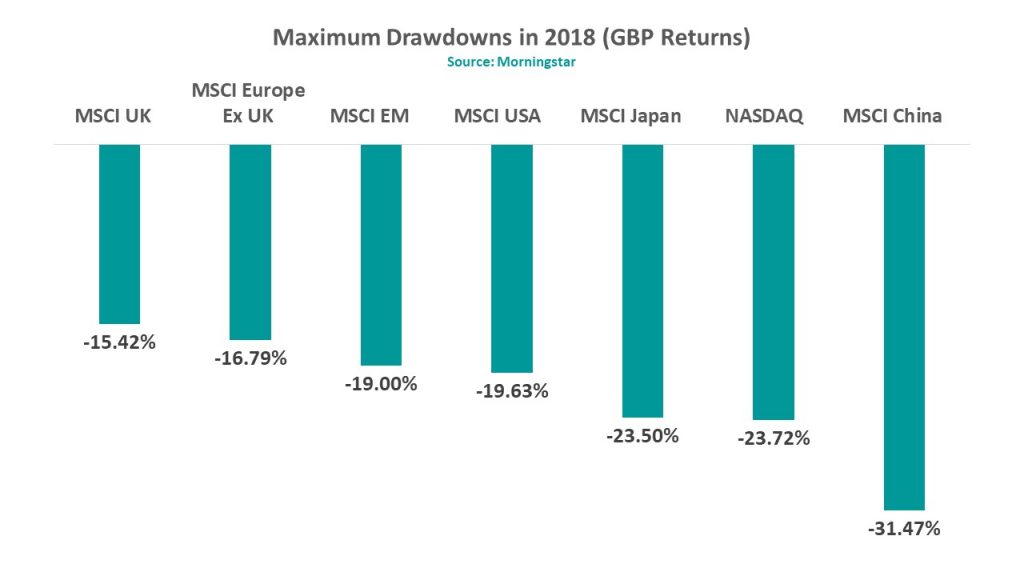

Equity returns in 2018 were not great. The sell-off commenced in earnest around August with the largest losses exhibited in China and technology companies. The Figure below shows the maximum drawdowns (peak to trough falls) of major equity indices in 2018.

To most, the performance of UK equities probably came as a surprise. To us, this was largely expected because low valuations provide a cushion that can absorb the blows of trade wars, political uncertainty and slowing global growth. Apart from our relatively large exposure to UK companies, our stabiliser assets (gold, cash and short dated government bonds) have also provided some protection against the recent sell-offs as expected.

While the turkey (and most other animals) can’t conceptualise the future, we humans can. Some of our fellow humans working in finance take this conceptualisation of the future to an unjustifiable extreme. At the turn of the new year, a lot of forecasts are thrown around. You don’t need to peer into a crystal ball to make good returns in the markets. A precise forecast of the future is not only impossible but unnecessary.

What do we expect the markets to do in 2019? Let’s imagine we were driving across the motorway on a foggy night. Trying to reach our destination by simply looking through the rear-view mirror would be a bad strategy. The turkeys that ended up as our Christmas dinner have not caught up to this fact just yet. Looking through the windscreen with full awareness that we can’t see clearly is the right approach as this will help us avoid other cars, deer and whatever else that may be lurking behind the fog.

Growing clients’ capital above inflation in the future relies on valuations today either being cheap or growth rates in the future being higher than those currently forecast. As our longer term readers will know, forecasting from one year to the next does not provide a sound basis for investing in our opinion. Therefore, our catalyst for growing returns in the coming years is twofold.

Firstly, the historic low valuations of UK equities which should correct themselves once the benefits of owning them becomes more apparent to global investors. Valuations have not been this attractive since the depths of the financial crisis in 2008. Secondly, and more longer term, the opportunities that have been thrown up by recent market declines in Emerging Markets.

Investment opportunities arise in the most unexpected of scenarios and at Tacit, our focus remains on these opportunities whilst the noise around politics seems to become ever louder.