Share this post

2%?

October, 2023

We hear a lot about inflation and its impact on living standards and interest rates, but what about growth? Whilst the world is fixated with the short-term inflationary picture, we share the view of many analysts that poor global growth prospects are being ignored by policymakers over the next 10 years.

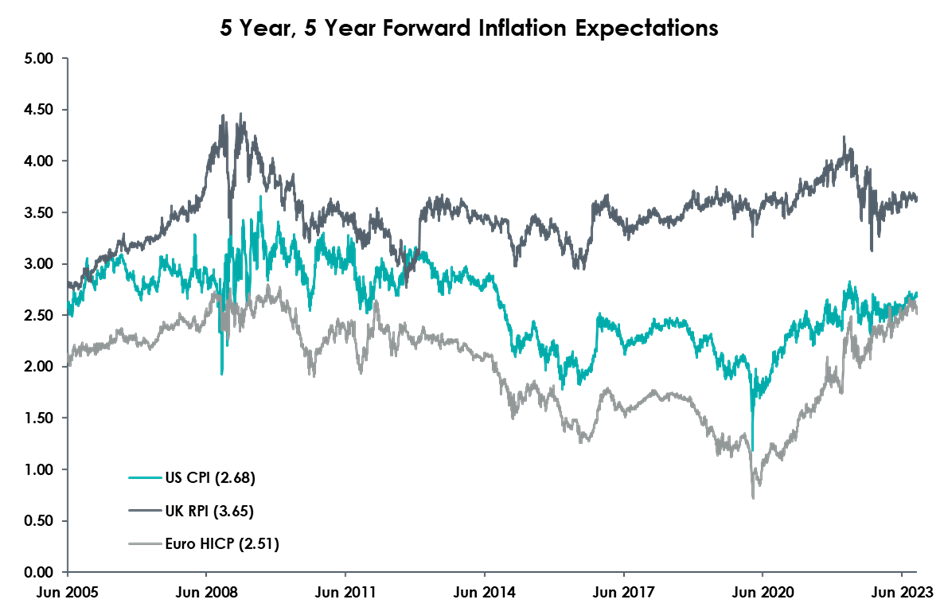

To cover off the point regarding inflation, the 2% inflationary target of the Bank of England in the UK and the Federal Reserve in the US have never actually been met historically. Inflation is either lower or higher in any given year. In fact, realised inflation in the UK has been close to 4% per annum over the past 100 years. The obsession with returning inflation to 2% therefore seems perverse. Forecasting where inflation will be over the coming years is very difficult for any individual country however markets assimilate all the available information at any point in time and guesstimate a forward-looking inflation number. The chart below shows this inflation number looking out 10 years for the UK, US, and Europe.

Source: Barclays Trading, IHS Markit, 5 Year, 5 Year Inflation Swap Rates for US CPI (Consumer Price Index), UK RPI (Retail Price Index) and European HICPX (Harmonised Index of Consumer Prices, from 7th June 2005 to 5th October 2023.

The chart clearly shows that US inflation expectations have averaged about 2.5% for the past 20 years with UK inflation expectations averaging about 3.5% over the same period. This chart illustrates why the fixation with a 2% target appears irrelevant, whilst also showing investors that long term inflation expectations are very well anchored.

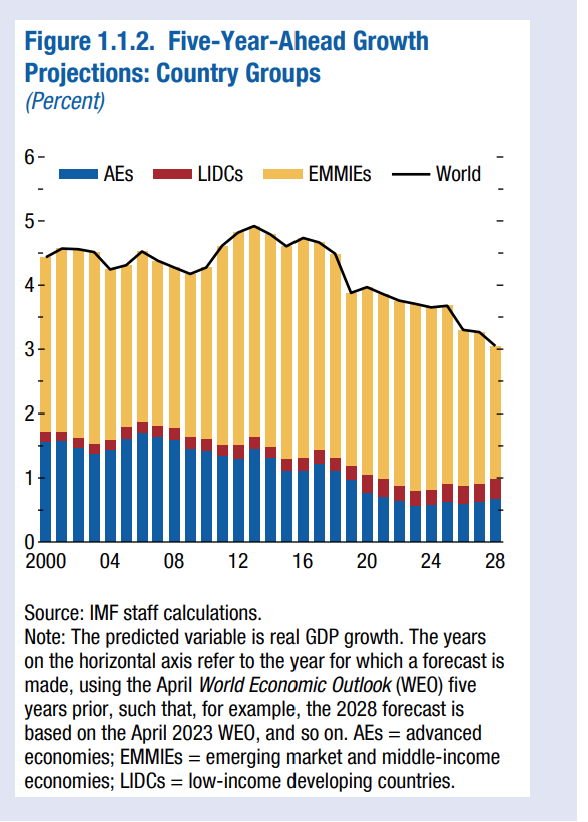

The focus for investors should be about future economic growth and cash flows which can grow in a world of relatively poor aggregate growth globally. The image below is taking from the International Monetary Fund’s latest economic publication and illustrates quite clearly that global economic growth is likely to be significantly lower than at any point in the last 20 years. This is primarily due to the poor performance of the developed world and a lag in the ability of less developed economies to supplement this poor growth in the short term.

In such an environment a larger proportion of investor returns will come from income as re-rating of markets becomes less certain. The focus of investors after the past two years, where interest rates have risen, and many equities have fallen in value should be on trying to generate positive real returns moving forward and we firmly believe that current market pricing provides a significant opportunity for investors who can be patient. When considering that expected UK inflation is 3.65% over the coming ten years, Tacit strategies have income yields of close to 4% at present (which are growing). This is the first time since we launched in 2010 that the income investors receive is higher than the expected inflation rate and bodes well for future real returns from our strategies.

The readjustment that has occurred in financial markets over the past two years will not repeat itself and therefore positioning for the world we foresee is vital to achieving good investment outcomes.