Share this post

Risk Adjusted Returns

July, 2019

At Tacit, we firmly believe that equities are a good thing in the long run. Over time, rising equity markets are good for confidence, good for an individual’s wealth and ultimately good for the economy as people spend more when they feel wealthier.

It is important however to remember that downturns in equity markets can never be foreseen and although relatively short lived most of the time, they do create psychological barriers for investors. Having been positive on equity markets for over three years now, we have noticed a distinct change in investor appetites for riskier assets this year. We remind our readers again that being invested BEFORE a market rise is vital and chasing a market is not a long term investment strategy that ends well.

Capturing rising markets is important for longer term returns. A common investor mistake is to chase returns and then get burned by an unforeseen event and then sell down exposure to equities when things are at their low.

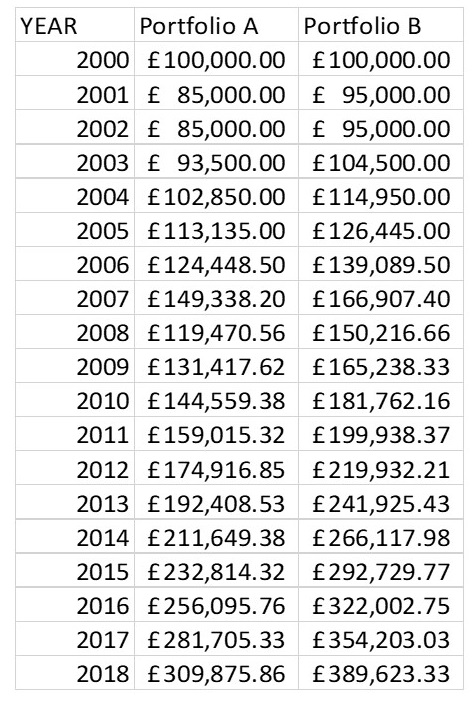

To illustrate a point, we consider two portfolios, each with the same asset allocation and risk attributes at first sight. Performance of the two is identical when markets are rising whilst one underperforms when markets experience a short term fall. The impact of this drawdown on longer term returns is actually higher than most would expect and is illustrated hypothetically below:

The only difference between the two portfolios is that Portfolio A has experienced bigger losses in 2000, 2008 and 2011 than Portfolio B. Overexposure to Technology in 2000 and Mining stocks in 2008 would have contributed the majority of this underperformance.

The power of compounding in this example would have resulted in a near £80,000 differential in performance for a client. Our approach to managing risk has led us to include Stabilisers in our highest risk strategies since launch as these help manage losses in difficult market scenarios. Being cognisant of factors such as this is just one of the reasons Tacit strategies have successfully provided strong risk adjusted returns for clients since launch.