Share this post

Beating the Market

April, 2018

Physics envy has done a lot of harm to economics and the humanities. This probably happened because of the astronomical leaps in physics starting with Newton in the 18th century where he predicted the motion of distant planets and Einstein in the 20th century where he showed the random motion of atoms. If physics could predict complex phenomena with great accuracy using maths and strange Greek symbols then surely it could be replicated in economics. The only problem with this is that humans, unlike planets and atoms, have emotions which greatly compounds the difficulty in understanding human behaviour.

The efficient market hypothesis (EMH), a likely product of physics envy is the building block of many financial models. It states that the market is perfectly efficient and all materially important information is fully incorporated into the price of a security. According to this hypothesis, all securities are perfectly priced making it impossible to outperform the broader market.

The assumptions made in the EMH by the academics are questionable. The assumption that every material piece of information is incorporated into the price of a security is patently wrong because people can react differently to the same information. This behavioural element was ignored by the academics because it made their financial models less elegant. Elegance took precedence over common sense because of physics envy.

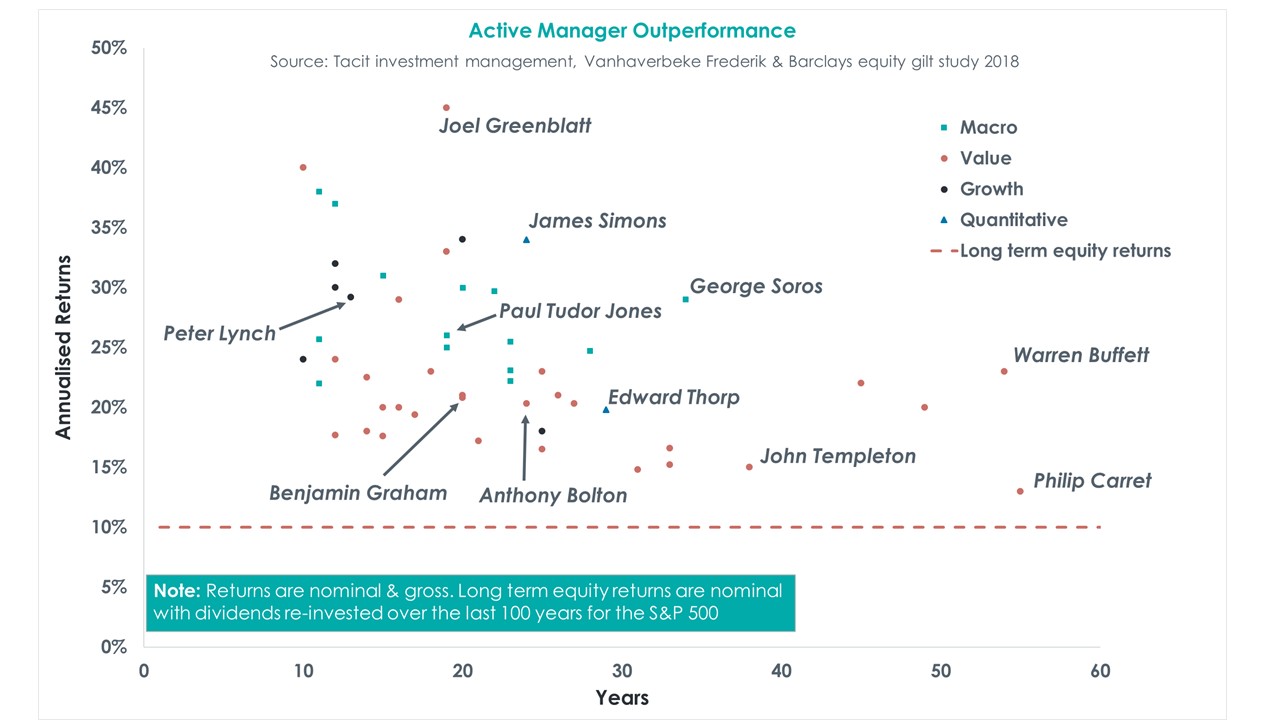

So, if the market isn’t perfectly efficient, how does one beat the market? There is more than one way to do this as shown in the figure below.

Different investors have different styles based largely on their personalities. The figure above shows 53 investors who have outperformed the broader market over 10 years or more. What is striking is that all the investors shown above have a particular style and they tend to stick to it, come rain or shine.

Another striking feature shared by these investors is that they have a circle of competence and don’t stray far away from it. For the quantitative investor, his edge is real time access to large data sets. For the growth investor, his edge is finding the high growth company with a large addressable market. For the value investor, his edge is finding the undervalued company which is neglected by the market. For the macro investor, spotting macro-economic trends are the tools of his trade.

While it is possible to beat the market, it is difficult to do so every year and no one style works all the time. Paradoxically, if one style of investing always worked, everyone would adopt it and it would cease to work.

The stock market is not perfectly efficient all the time. It is however efficient most of the time because intelligent investors are always looking for under-priced securities which pushes up prices to their fair value. Pockets of inefficiency often arise during a panic allowing the good active manager to pick up bargains that have been forsaken by the market.

At Tacit, understanding our circle of competence and staying within it is key to our performance. This means that in some years we will inevitably lag the market. Avoiding ‘market envy’ and focusing on long term returns and capital preservation will continue to be our anchor going forward.